- What Payment Options Does the IRS Accept?

- How To Set Up Your IRS Online Account?

- How to Pay Online Directly Through The IRS Website?

- Direct Pay –

- Pay With Debit or Credit Card

- Using EFTPS for Recurring or Business Payments

- Paying via the IRS2Go App

- Why Pay Taxes Online Through the IRS?

- What to Do If You Can’t Pay in Full?

- A Few Things To Consider:

- A Few Things To Avoid

- When to Get Help?

- Wrapping it Up

Paying taxes online is another way to unwind ourselves, as it’s a quick and simple process that doesn’t require waiting in line.

However, when paying IRS bills, you might wonder if there’s a way to pay them via the IRS website. The good news is: Yes, there is a way. Using the IRS or Internal Revenue Service, you can pay your taxes online without jumping through a million hoops.

We’ve compiled all the processes in this article, so you don’t have to go anywhere else. We’ve broken down not only how you can pay your federal taxes directly through the IRS, but also how you can explore other options. Let’s dive in.

What Payment Options Does the IRS Accept?

The IRS offers several ways to pay federal taxes online through its website, IRS.gov. Here are the main options:

- IRS Direct Pay: This is the go-to method for most people. It lets you pay directly from your bank account (checking or savings) for free. You can use it for tax returns, estimated taxes, or payments toward a balance due.

- Debit or Credit Card: You can pay with a debit or credit card through third-party processors linked on IRS.gov. There’s a small processing fee, but it’s handy if you don’t want to use your bank account.

- Electronic Federal Tax Payment System (EFTPS): This is great for businesses or individuals making large or recurring payments, like quarterly estimated taxes. It’s also free and works via bank account transfers.

- IRS2Go App: The IRS’s mobile app lets you make payments on the go, either through Direct Pay or card processors. It’s perfect if you’re always on your phone.

We love Direct Pay for its simplicity—no fees and no middleman. But if you’re racking up credit card points or need a business-friendly system, the other options are solid too.

How To Set Up Your IRS Online Account?

Before you start throwing money at the IRS, it’s a good idea to set up an IRS online account at IRS.gov.

This isn’t mandatory for all payment methods, but it’s a lifesaver for tracking your payments and checking your balance. Here’s how to get started:

- Go to IRS.gov: Head to the “Your Online Account” section.

- Verify Your Identity: You’ll need your SSN, ITIN, or EIN, plus some personal info like your address or previous tax return details. The IRS uses ID.me for secure verification.

- Link Your Info: Once verified, you can see your tax balance, payment history, and even set up payment plans.

We’ve found that having an account makes everything smoother—you can check if your payment has posted and avoid those “did it go through?” jitters.

How to Pay Online Directly Through The IRS Website?

Direct Pay –

Direct Pay is our favorite way to pay because it’s free and straightforward. Here’s how to do it:

- Visit IRS.gov: Go to the “Pay” section and click “Pay Now with Direct Pay.”

- Choose Your Payment Type: Select what you’re paying for—tax return balance, federal tax deposit, estimated taxes, or a specific notice (like a CP14 or CP2000). Have your notice number handy if applicable.

- Verify Your Identity: Provide your SSN/ITIN/EIN, tax year, and filing status. This ensures your payment goes to the right place.

- Add Bank Info: Enter your bank account and routing numbers. Double-check these—typos can cause headaches.

- Schedule Your Payment: You can pay immediately or schedule it for a future date (up to 365 days out). This is great for planning ahead.

- Confirm and Save: You’ll get a confirmation number. Write it down or screenshot it for your records.

Note: We always schedule payments a few days before the deadline to avoid last-minute stress.

Direct Pay is super secure, but make sure you’re on the real IRS.gov site—scammers love to fake it.

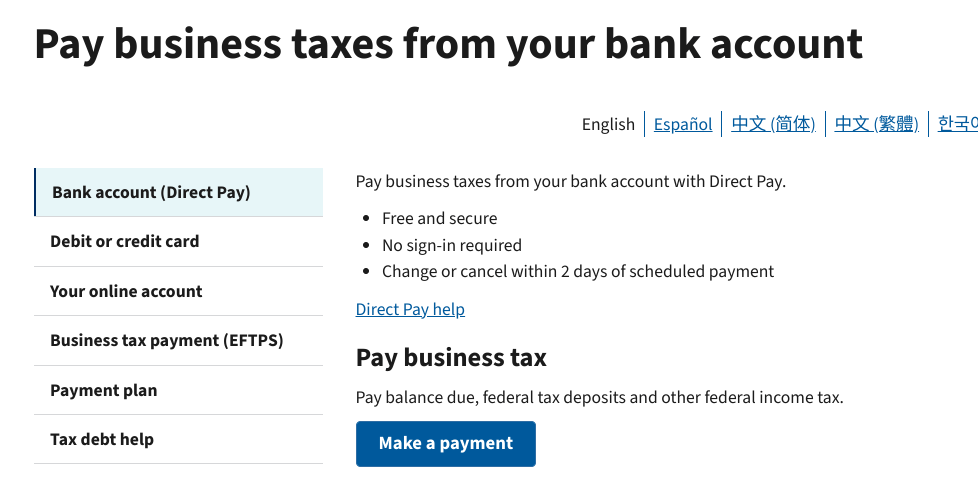

Pay With Debit or Credit Card

If you’d rather not use your bank account, you can pay with a debit or credit card through third-party processors like PayUSAtax, Pay1040, or ACI Payments. Here’s the deal:

- Go to IRS.gov: Tap “Pay by Debit or Credit Card” under the “Pay” section.

- Choose a Processor: Each has slightly different fees (usually 1.75%–1.85% for credit cards, less for debit). Tap “Make a Payment” after picking one that works for you.

- Enter Payment Details: You’ll need your tax info (SSN/ITIN, tax year) and card details.

- Confirm: After passing all five steps, you’ll get a confirmation email or a receipt.

We’ve used this when we wanted to earn credit card rewards, but those fees can add up for big balances. Compare the costs before you commit.

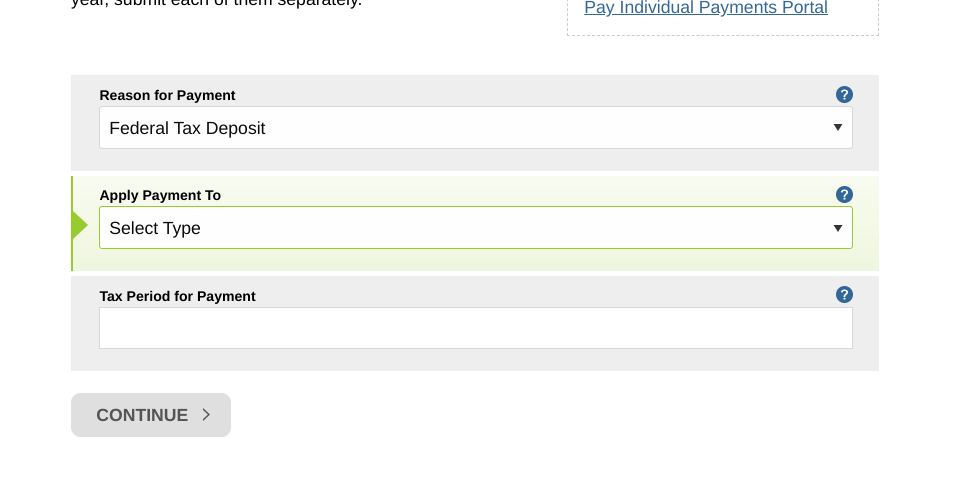

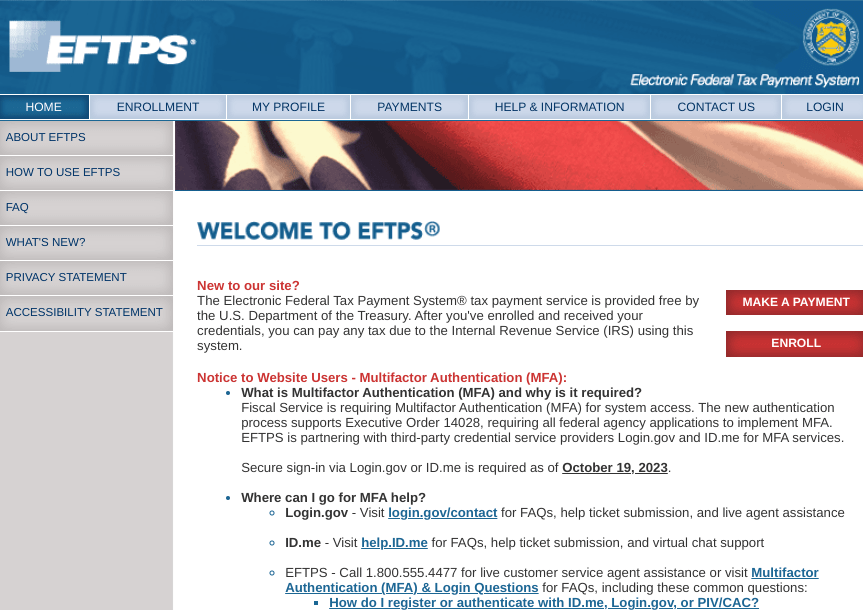

Using EFTPS for Recurring or Business Payments

EFTPS is a bit more involved, but perfect for businesses or freelancers making quarterly estimated taxes. Here’s how to set it up:

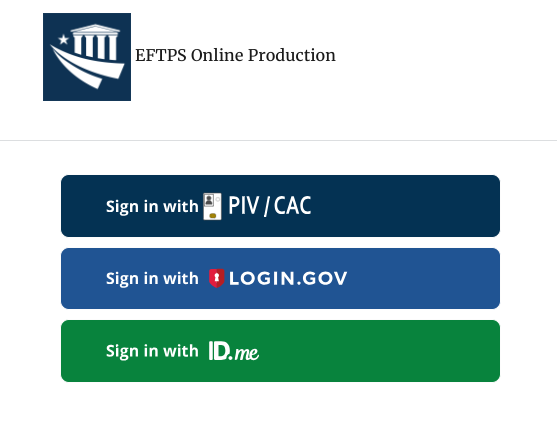

- Enroll at EFTPS.gov: You’ll need your EIN or SSN and bank info. The IRS will mail you a PIN for security, which takes a few days.

- Log In: Use your PIN and create a password.

- Schedule Payments: You can set up one-time or recurring payments, which is awesome for staying on top of estimated taxes.

- Track Everything: EFTPS keeps a record of all your payments.

We recommend EFTPS if you’re self-employed or run a business—it’s like autopilot for tax payments.

Paying via the IRS2Go App

On the go? The IRS2Go app (available for iOS and Android) lets you pay from your phone. You can use Direct Pay or a card processor, and it’s as simple as the website. Just download the app, log in with your IRS account (or create one), and follow the prompts.

We love this for quick payments when we’re away from our laptops.

Why Pay Taxes Online Through the IRS?

Paying your federal taxes online directly through the IRS is a game-changer. It’s fast, secure, and saves you the hassle of mailing checks or visiting a tax office.

Whether you owe taxes from your annual return, need to make quarterly estimated payments, or are settling a balance from an IRS notice, doing it online means you can handle everything from your couch.

Plus, you get instant confirmation that your payment went through—no worrying about lost checks. We’ve all had that moment of panic wondering if our payment made it, right? Let’s explore how to make this happen.

What to Do If You Can’t Pay in Full?

Owing more than you can pay right now? Don’t panic—the IRS offers payment plans. Through your IRS online account, you can apply for:

- Short-Term Plan: Up to 180 days to pay, no setup fee.

- Long-Term Plan: Monthly payments for larger balances, with a small setup fee (waived for low-income taxpayers).

Go to IRS.gov, click “Apply for a Payment Plan,” and follow the steps. You’ll need your balance info and financial details. We’ve found that setting up a plan online is way easier than calling or filling out forms.

A Few Things To Consider:

- Double-Check Everything: Wrong bank numbers or tax years can delay your payment. Take a second to review.

- Save Confirmations: Keep those confirmation numbers in a safe place (we use a “Tax Stuff” folder in our email).

- Pay Early: Avoid last-minute glitches by paying a few days before deadlines like April 15 or quarterly estimated tax dates (January 15, April 15, June 15, September 15).

- Beware of Scams: Only use IRS.gov or EFTPS.gov. If a site looks shady or asks for weird info, run.

- Check Your Balance: After paying, log into your IRS account to confirm the payment posted.

A Few Things To Avoid

We’ve all been there, making a slip-up that turns a simple task into a headache. Here’s what to watch out for:

- Using the Wrong Tax Year: Make sure you’re paying for the right year or notice.

- Ignoring Fees: Credit card payments come with fees—know what you’re signing up for.

- Missing Deadlines: Late payments can trigger penalties and interest. Set calendar reminders.

- Not Keeping Records: Without that confirmation number, it’s hard to prove you paid if something goes wrong.

When to Get Help?

If your tax situation is a mess—say, you owe a ton or got a scary IRS notice—consider a tax pro. Enrolled Agents or CPAs can guide you through payment plans or disputes.

Find one through the IRS Directory of Federal Tax Return Preparers. It’s an extra cost, but it can save you stress. You can also speak to the IRS representatives and put forward your issue.

Wrapping it Up

Paying your federal taxes online directly through the IRS is easier than ever, whether you’re using Direct Pay, a card, EFTPS, or the IRS2Go app.

With a little prep and the right tools, you can knock it out in minutes and get back to your life. We’re rooting for you to tackle tax season like a champ! So head to IRS.gov, pick your payment method, and take control. You’ve got this!