- Understanding the IRS Refund Schedule

- Why’s My Tax Refund Taking So Long?

- How to Track Your IRS Refund Status?

- Tips to Get Your Tax Return Faster

- What to Do If Your Refund Is Seriously Late

- Wrapping It Up:

- Frequently Asked Questions (FAQs)

- 1. How long does it take to get my tax return?

- 2. How can I check the status of my IRS refund?

- 3. Why is my IRS refund delayed?

- 4. What does it mean if my refund is “under review”?

- 5. Can I speed up my IRS refund?

- 6. What should I do if I haven’t received my tax return after 21 days?

- 8. What happens if I enter the wrong bank info for my refund?

- 9. Can I still get my refund if I owe taxes or other debts?

You’ve filed your taxes, maybe even celebrated with a coffee for surviving the ordeal, and now you’re refreshing your bank account like it’s a full-time job. “Where’s my IRS refund?” you mutter, wondering if your money’s lost in some government black hole.

We’ve all gone through the refund process once in our lives. So getting a refund from the IRS is not so different, once you’ve set up your account and submitted your credentials. So without any further delays, let’s tap into all the major aspects of it.

Understanding the IRS Refund Schedule

The IRS isn’t exactly known for lightning-fast service, but they do have a rhythm to their refund process. If you’re the tech-savvy type who e-files and chooses direct deposit, you’re usually looking at 21 days from the time the IRS accepts your return. That’s the sweet spot for most straightforward filings. If you’re old-school and mailed a paper return, bide your time—it could take somewhere 6 to 8 weeks.

Here’s a quick peek at the 2025 refund timeline, based on when you hit “send”:

- Early Filers (January 27 – February 15): If you’re the type who files the second the IRS opens (usually late January), you could see your refund by mid-February. Pat yourself on the back for being so on top of it!

- Mid-Season Filers (February 16 – March 31): File in this window, and your money should roll in by early to mid-April. Perfect timing for a spring splurge.

- Last-Minute Filers (April 1 – April 15): If you’re scrambling to file by the April 15 deadline, don’t expect your refund until early May. Procrastination has its price!

Heads-up: If you’re claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC), the IRS holds those refunds until mid-February to double-check for fraud, thanks to the PATH Act. So, add a couple of weeks if those credits are in play.

Why’s My Tax Refund Taking So Long?

We get it, waiting to claim your refunds sometimes feels like looking for a text back from your crush – pure agony. Here are the reasons behind such delays.

- Errors on Your Return: A tiny slip-up, like a wrong digit in your Social Security number or a math error, can make the IRS hit the pause button. They’ll flag your return for a closer look, which means more waiting.

- Identity Verification: It’s quite a boring step, yet an important process to secure your IRS account from the hands of fraudsters. If the IRS finds something suspicious, they can ask you to submit your documents or answers to verify your originality.

- Complex Returns: Got a side hustle, multiple credits, or itemized deductions? Your return might need extra scrutiny, slowing the process to a crawl.

- Paper Filing: Mailing your return is like sending a carrier pigeon—it’s slow and unpredictable. E-file next time to save your sanity.

- IRS Backlogs: Sometimes, the IRS is just slammed. Think millions of returns, limited staff, or tech glitches. It’s like a rush-hour pile-up in Taxville.

If your refund’s running late, don’t just stew—check its status to see what’s up.

How to Track Your IRS Refund Status?

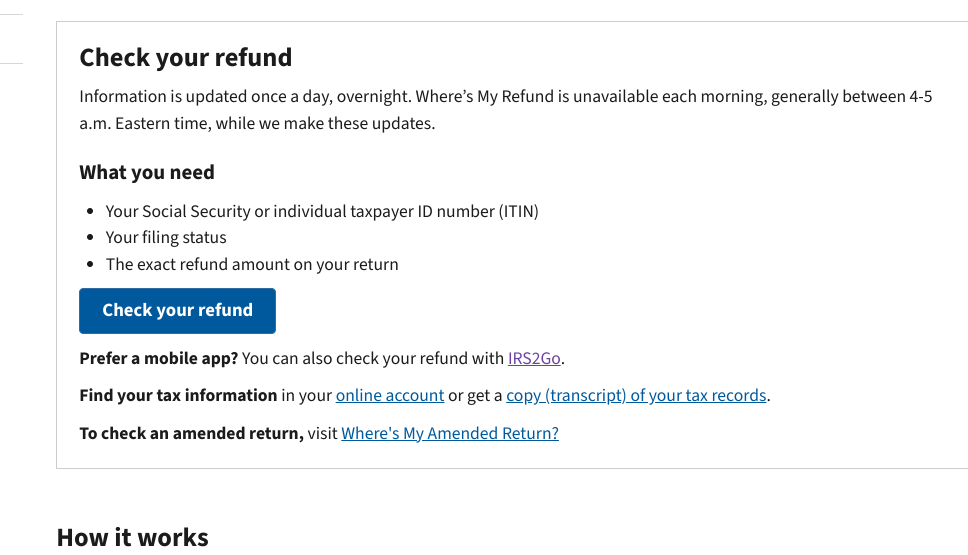

Tracking your IRS money is as straightforward as you can imagine. All you need to do is tap on “Where’s My Refund on IRS.gov, and it will show your available refund after all deductions. Here’s the breakdown –

- Gather Your Info: Grab your Social Security number (or Taxpayer ID), filing status, and the exact refund amount from your return.

- Check Online or Via App: Visit IRS.gov or fire up the IRS2Go app. Access your account, and you’ll see one of three updates:

- Received: The IRS has your return and is working on it.

- Approved: Your refund’s green-lit, and you’ll get an estimated deposit date.

- Sent: Cha-ching! Your money’s on its way to your bank or mailbox.

- Wait 24 Hours (E-Filers): E-filers can check after 24 hours, but paper filers need to wait 4 weeks. The tool updates daily, so don’t spam it.

If you see a “further review” message, don’t lose your cool. It might just mean the IRS is dotting their i’s. If they need something from you, they’ll send a letter—watch your mailbox like a hawk.

Tips to Get Your Tax Return Faster

We all want that cash in hand ASAP, so here’s how to avoid getting stuck in the slow lane:

- Go Digital: E-filing with direct deposit is the quickest way to get paid. It’s like picking the express lane at the grocery store.

- Double-Check Your Return: Before you file, review your numbers, Social Security info, and bank details. One typo can derail your refund train.

- Keep It Simple: If your taxes are straightforward, stick with the standard deduction unless itemizing saves you serious dough.

- Respond Promptly to IRS Notices: If the IRS sends you a letter, don’t let it sit on your counter collecting dust. Respond fast to keep things moving.

What to Do If Your Refund Is Seriously Late

If it’s been over 21 days (or 8 weeks for paper filers) and your refund’s still ghosting you, it’s time to take charge. Start with “Where’s My Refund?” to check for updates or error codes. If you’re getting nowhere, call the IRS at 1-800-829-1040. Fair warning: you might be on hold longer than a Netflix binge. If you’re in a financial pinch, reach out to the Taxpayer Advocate Service for backup.

Wrapping It Up:

IRS refunds can be time-consuming and frustrating at the same time. So it’s crucial to detect your refund before you hand up. To avoid such a circumstance, file early and monitor your refund’s status.

So, if things get out of hand, reach out to the IRS and put your issue forward so they can handle it like a pro.

Frequently Asked Questions (FAQs)

1. How long does it take to get my tax return?

It could take around 21 days to get your e-file refund. Paper filers may’ve to wait for 6 to 8 weeks to claim their credits. And to claim credits for EITC or ACTC, you should wait until mid-February due to extra IRS checks.

2. How can I check the status of my IRS refund?

You can check your IRS refund status directly. Or you can log in to your account via IRS.gov or the IRS2GO app, search for “Where’s My Refund?” and follow the process.

3. Why is my IRS refund delayed?

IRS refund delays can occur due to a host of reasons, like faulty SSN, identity verification requests, complex returns, or IRS backlogs. And paper returns usually take longer to process, so you must wait a few more days.

4. What does it mean if my refund is “under review”?

If you bump into any message like “under review,” – it means the IRS received your e-file and is reviewing it. Or it can be another error that may need extra verification for credits like the EITC.

5. Can I speed up my IRS refund?

There is no way to speed up your IRS refund. However, if you opt for E-file instead of mailing your return, you can get your return much faster.

6. What should I do if I haven’t received my tax return after 21 days?

I could be disheartened if you don’t receive your refund after a long wait of 21 days. However, we advise Paper filers to wait nearly 8 weeks, and if it’s taking longer than usual, call 1-800-829-1040. Since contacting IRS representatives via phone can be a bit frustrating, you must be patient. The last advice we can offer is to contact the Taxpayer Advocate Service.

8. What happens if I enter the wrong bank info for my refund?

It won’t eat up your refund, though, but it will delay your refund by weeks. When you put the wrong bank details, the IRS will usually mail you a paper check to the address on your return.

9. Can I still get my refund if I owe taxes or other debts?

It is a bit tricky to get your IRS refund if you owe any taxes or loans. IRS may adjust those credits to cover your debts. However, you’ll be updated about what you owe and what has been offset.