- What’s IRS Direct Pay?

- How to Use IRS Direct Pay

- Who Can Use It?

- What Payments Can You Make?

- Its Perks

- Drawbacks

- Fixing Problems

- Alternatives

- Pro Tips

- Need Help?

- FAQs

- What can I pay?

- Will I get proof?

- Can I schedule ahead?

- How do I change a payment?

- Did the IRS get my money?

- Can I pay for my spouse?

- What about non-U.S. banks?

- Lost my confirmation number?

- Website down?

- Wrapping Up

Paying taxes online can sometimes be frustrating, especially when there are not so many options around and the network is busy. But the IRS Direct Pay system? It makes things way easier.

This free online tool lets you send money straight from your bank account. No fees. No hassle. Just a few clicks, and you’re done. Here’s everything you need to know to use it like a pro.

What’s IRS Direct Pay?

IRS Direct Pay is just a shortcut for paying taxes, run by the IRS. You transfer money from your bank account to cover federal taxes—no need to mail checks or deal with third-party apps.

Plus, it’s free. Here’s why it stands out from the rest.

- No fees. Unlike credit cards, it incurs no fee.

- Instant proof. Get a confirmation number right away.

- Safe and secure. Your info stays protected with top-notch encryption.

- Plan. Schedule payments up to a year in advance.

- No sign-up. Jump in without creating an account.

How to Use IRS Direct Pay

Ready to pay? It’s as easy as ordering your favorite item online. Follow these steps:

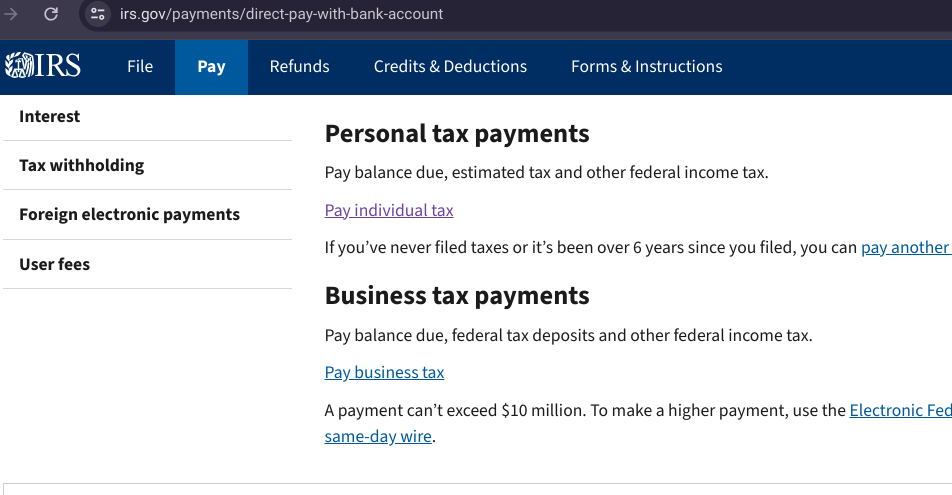

- Go to the website.

- Visit irs.gov/payments. Ensure you’re on the official site to stay safe.

- Select your payment type: Choose why you’re paying. Personal Tax or Business Tax. Maybe it’s a balance due or other federal taxes.

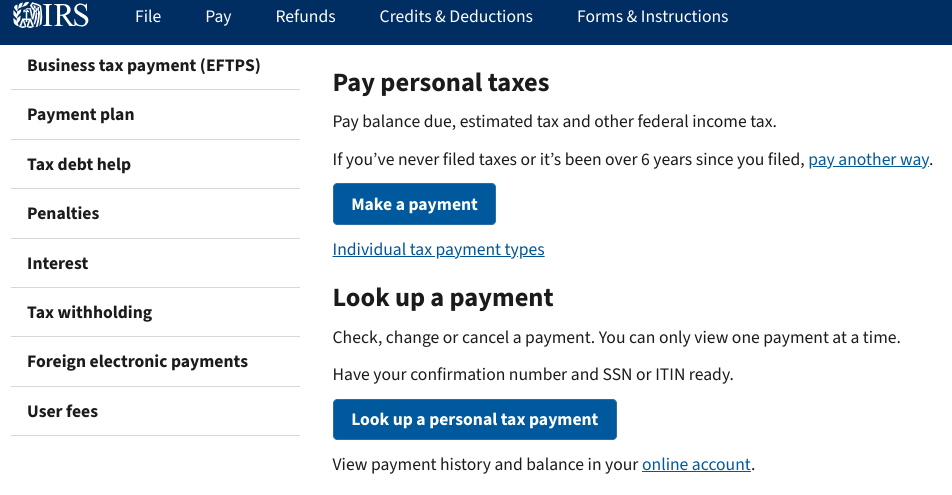

- Choose Pay personal taxes: You’ll see two options here – select Pay personal taxes and click on “Make a payment”. If you want to cancel or change your payment details, choose “Look up a payment”.

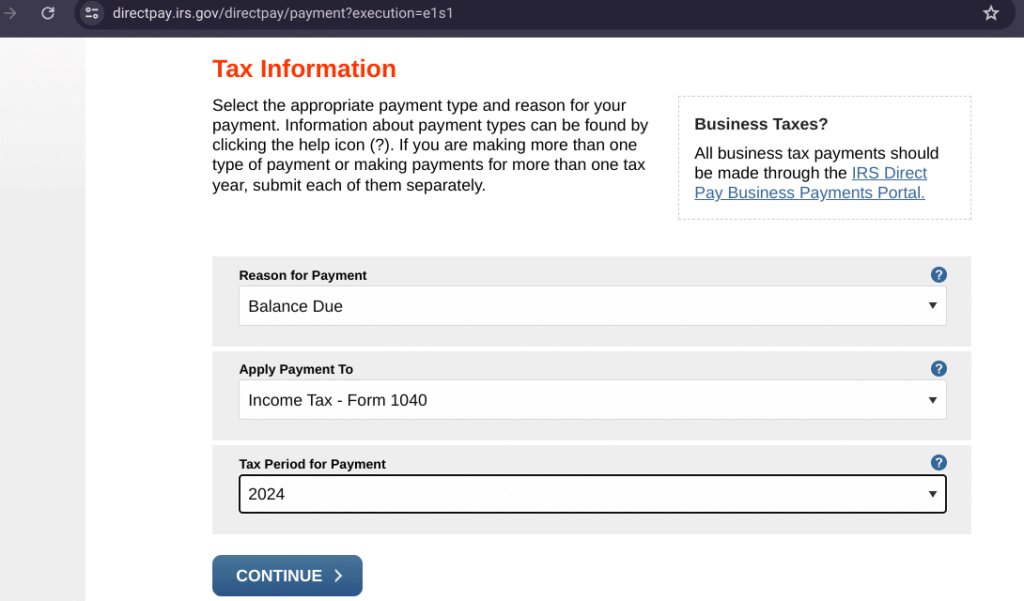

- Fill in Tax Details. Select your payment type, the reason to make a payment, and the tax period. For example, your payment reason is “Balance due” and payment to “Form 1040”.

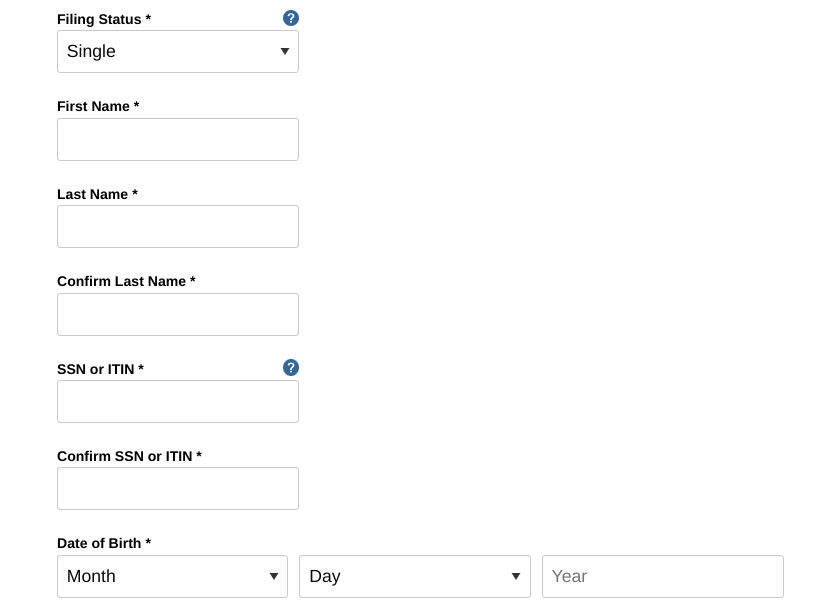

- Verify Your Identity: Now enter your details such as your name, SSN, Country of Residence, city, state, and more, and hit Continue.

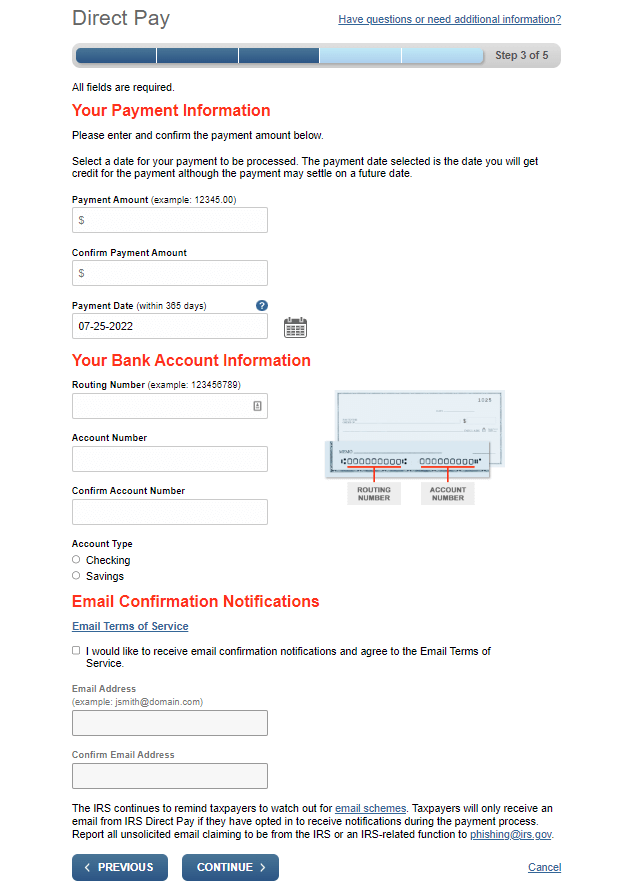

- Add Payment information. Type in your bank account and routing numbers. Choose checking or savings. Enter the amount you wish to pay and set the payment date—today or up to a year out.

- Confirm the payment. Check everything. Hit submit. Save the confirmation number. You can download or print it too.

- Track it. Use the “Payment Lookup” tool to check status. You can tweak or cancel payments two business days before they process.

Who Can Use It?

Almost anyone paying federal taxes can use this tool. But there are a few rules.

- Individuals. Filed a tax return in the last six years? You’re good. You’ll need your Social Security Number and some return details.

- Businesses. Got an Employer Identification Number (EIN)? You’re set. Works for LLCs, nonprofits, and more.

- Joint filers. Either spouse can pay, but the bank account must match the person starting the payment.

- Heads up. No non-U.S. bank accounts. Some apps like Chime won’t work either.

What Payments Can You Make?

This tool covers lots of tax types. Here’s the overview:

- Personal taxes. Pay what you owe on your Form 1040, estimated taxes, or extensions.

- Business taxes. Handle payroll, quarterly estimates, or balances due.

- Other stuff. Cover gift taxes, estate taxes, or penalties.

One catch? Payments can’t exceed $10 million per transaction. Need more? Try the IRS’s Electronic Federal Tax Payment System (EFTPS).

Its Perks

IRS Direct Pay saves time and stress. Here’s why you should bank on it :

- Super convenient. Pay from your couch. No stamps needed.

- No cost. Credit cards charge fees. This doesn’t.

- Fast. Payments hit your IRS account in a day or two.

- Secure. Your bank info stays locked down.

- Flexible. Set payments for next week or next year.

- Easy access. No account needed to get started.

If you miss your deadlines, you can set up instant notification with the IRS Direct Pay so you don’t lose track of your due dates.

Drawbacks

No tool is perfect. Here are some limits:

- Limited To Two-payment. You can only pay twice per day from one bank account

- U.S. banks only. If you’ve a foreign bank account, you can’t use this, as international accounts won’t work.

- Can’t cancel payment. You can’t cancel or change payments after two business days before the date.

- Not for refunds. This platform is built to pay, not to get your money back.

- Some business taxes. You might require EFTPS for complex payroll stuff.

Fixing Problems

Sometimes things go wrong. Here’s how to fix common issues:

- Payment rejected? Check your bank balance. Make sure your tax return details match exactly.

- Verification failed? Use details from the exact year you’re verifying. Moved recently? Use your old address from the return.

- Money sent, but IRS says no payment? Wait 48 hours. Still an issue? Call the IRS.

- Website not working? It might be maintenance time. Try EFTPS or the IRS2Go app.

- Wrong bank details? Typos can delay things. Double-check before hitting submit.

If your payment got stuck because of a typo in the routing number, you can call the IRS, and they’ll sort it out.

Alternatives

Need more options? No stress. Plenty of simple ways exist to pay federal taxes. These alternatives would’ve saved the day.

- EFTPS: The Electronic Federal Tax Payment System handles all taxes—personal, business, and payroll. Free to use. Sign-up takes a week for a PIN. Schedule payments a year out. Great for frequent business filings. If you use it for quarterly taxes, you can save more.

- Credit or Debit Card: You can pay via processors like Pay1040. Visa, Mastercard, PayPal—all work. Super fast, online or phone. Fees sting: $2-$2.50 for debit, 1.85% for credit. A $1,000 bill? $18.50 extra.

- Electronic Funds Withdrawal: Pay from your bank when e-filing with software like TurboTax. No fees. Enter bank details, and it’s done. The caveat is you can’t schedule post-deadline.

- Mail a Check: Simply write a check to “U.S. Treasury.” You’ve to add Social Security Number, tax year, and form number. Mail with Form 1040-V. Check the IRS site for the address. It is a slow process that can take weeks.

- Cash at Stores: You can pay up to $1,000 daily at 7-Eleven via PayNearMe. Fees apply. Takes days to process.

- Same-Day Wire: Bank sends money the same day. Simply fill out theIRS worksheet. Bank fees may vary and can have a tricky setup. One of our clients used it for a last-minute save. Stressful, but worked.

IRS Direct Pay is still the best option among its rivals. EFTPS is good for businesses, cards are quick but levy charges, and EFW is great with e-filing. Checks and cash? They’re slow but steady. So you can opt for anything you like.

Pro Tips

Want to make the most out of it? Try these:

- Keep records close. Have your tax return handy for verification.

- Check bank info. One wrong digit can mess things up.

- Save confirmations. Store that number somewhere safe.

- Pay early. Hit deadlines by 8 PM Eastern Time.

- Get an IRS account. It saves time for future payments.

- Stay in the know. Check the IRS site for updates or outages.

Need Help?

Need more info? Check these out:

- IRS Direct Pay site. Visit directpay.irs.gov for payments and FAQs.

- IRS support. Call 1-800-829-1040 or check the IRS Contact Page.

- IRS2Go app. Pay and track refunds on your phone.

- IRS Online Account. See your payment history and more.

FAQs

Got questions? Here are answers to the big ones:

What can I pay?

Income taxes, estimated taxes, business taxes, penalties, and more.

Will I get proof?

Yes. A confirmation number pops up instantly. Save it.

Can I schedule ahead?

Pick any date up to a year out. Just meet tax deadlines.

How do I change a payment?

Simply use “Payment Lookup” to edit or cancel two days before it processes.

Did the IRS get my money?

You should check your IRS Online Account after 48 hours. If there’s an issue, call 1-800-829-1040.

Can I pay for my spouse?

Yes, if the bank account matches the person starting the payment.

What about non-U.S. banks?

Sorry, not supported. You can try EFTPS or a credit card.

Lost my confirmation number?

You can find it in your IRS Online Account.

Website down?

Try EFTPS or the IRS2Go app. Or call 1-800-829-1040.

Wrapping Up

IRS Direct Pay is undoubtedly the best way to pay off your federal taxes. It’s free, fast, and secure. You can pay from anywhere, anytime, without any login, checks, or fees.

All you need to do is follow a few steps, and you’re done. You can follow these steps, watch for pitfalls, and you’ll handle taxes like a pro. If you got a big payment coming up, try it out. It’s easier than you think.