- What Is COGS?

- The COGS Formula

- Here’s How To Calculate COGS

- Why COGS Matters

- Examples of COGS Calculations

- Example 1: Custom Jewelry Shop

- Example 2: Subscription Box Service

- Common Mistakes to Avoid

- COGS vs. Operating Expenses

- How to Use COGS

- Practical Tips for Tracking COGS

- Real-World Applications

- COGS FAQs

- 1. What costs go into COGS?

- 2. Can COGS include labor costs?

- 3. How often should COGS be calculated?

- 4. What if the ending inventory is zero?

- 5. Why is COGS different for service businesses?

- 6. How does COGS affect taxes?

- 7. Can COGS be negative?

- 8. What’s the difference between COGS and expenses?

- 9. How can a business lower COGS?

- 10. Is COGS the same for retail and manufacturing?

- Wrapping It Up

Ever wondered what it takes to figure out the cost of goods sold (COGS)? It’s a key number for any business. Why? It shows the direct costs tied to making or buying products sold. Knowing COGS helps track profitability, set prices, and keep finances in check.

This article breaks down the COGS formula, shares practical examples, and answers common questions. Are you ready to dive in? Let’s make COGS simple and actionable.

What Is COGS?

COGS stands for cost of goods sold. It’s the total cost of producing or purchasing the goods a business sells during a specific period.

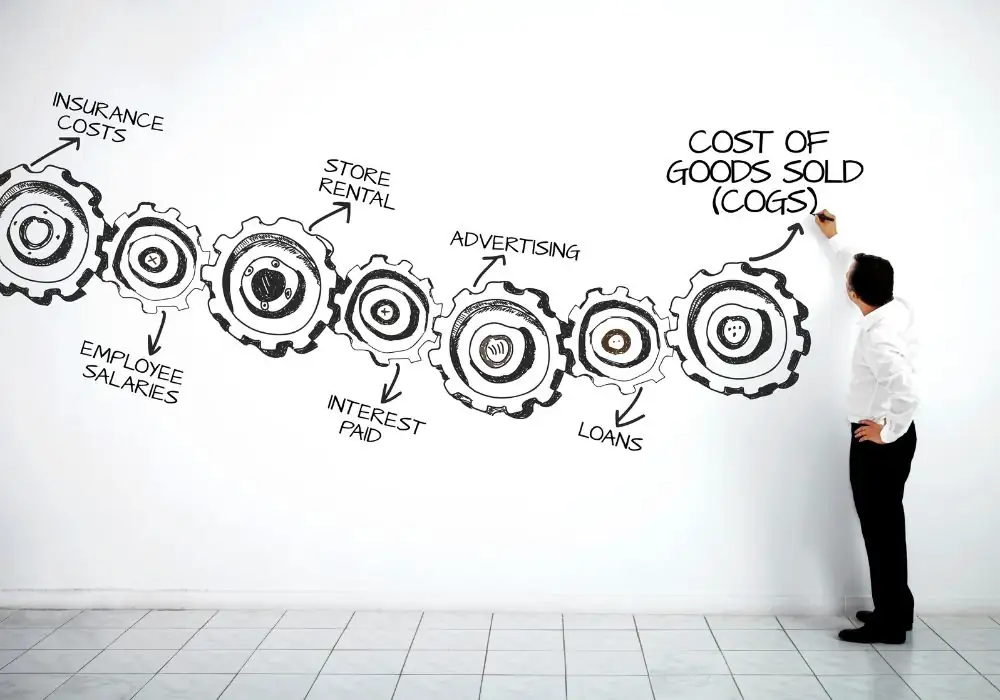

Think raw materials, direct labor, and manufacturing supplies. Not included? Overhead costs like rent or marketing. COGS matters because it directly impacts gross profit. The good news? Calculating it is straightforward with the right approach.

The COGS Formula

Here’s the basic formula for COGS:

COGS = Beginning Inventory + Purchases – Ending Inventory

- Beginning Inventory: Value of inventory at the start of the period.

- Purchases: Costs of additional inventory or materials bought during the period.

- Ending Inventory: Value of unsold inventory at the period’s end.

This formula tracks what’s spent to produce or acquire goods sold. Simple, right? Accurate records are key to getting it right.

Here’s How To Calculate COGS

Calculating COGS is like following a recipe. Here’s a 4-step process to nail it:

- Find Beginning Inventory: Check the value of inventory at the period’s start. You can use accounting records or software for accuracy.

- Add Purchases: Include costs of materials, labor, or goods bought during the period. You must only count what’s used for production.

- Determine Ending Inventory: You’ve to count the value of unsold goods at the period’s end. Physical counts or software help here.

- Apply the Formula: Now subtract ending inventory from the sum of beginning inventory and purchases. Make sure you double-check for errors.

Consistency in time periods—monthly or yearly—ensures reliable results. Tools like QuickBooks or Excel can simplify tracking.

Why COGS Matters

COGS is a window into a business’s efficiency. It shows how much is spent to generate sales. Lower COGS? More room for profit. Higher COGS? Time to rethink costs or pricing. It’s also critical for calculating gross profit (Revenue – COGS).

Businesses use COGS to set prices, manage inventory, and plan budgets. The best part? It’s a number that tells a story about operations.

Examples of COGS Calculations

To make COGS crystal clear, let’s look at two fictional businesses: a custom jewelry shop and a subscription box service. These examples show how COGS works in different industries.

Example 1: Custom Jewelry Shop

Support you own jewelry shop that sells handmade necklaces. In January, you start with $10,000 in inventory (gems, metals). You buy $5,000 in materials and has $4,000 in unsold inventory by month’s end.

- Beginning Inventory: $10,000 (starting gems and metals).

- Purchases: $5,000 (new materials bought).

- Ending Inventory: $4,000 (unsold materials).

- COGS: ($10,000 + $5,000) – $4,000 = $11,000.

Your shop’s COGS is $11,000, reflecting the costs of materials used for necklaces sold. Easy to track with good records.

Example 2: Subscription Box Service

A company curates monthly gift boxes. It begins with $20,000 in inventory (boxes, products). It spends $15,000 on new items and ends with $8,000 in unsold stock.

- Beginning Inventory: $20,000 (starting stock).

- Purchases: $15,000 (new products bought).

- Ending Inventory: $8,000 (unsold boxes).

- COGS: ($20,000 + $15,000) – $8,000 = $27,000.

The service’s COGS is $27,000, covering the costs of items included in sold boxes. Accurate inventory counts are crucial.

These examples show COGS in action. Different industries, same formula. Keep records tight, and it’s smooth sailing.

Common Mistakes to Avoid

Calculating COGS sounds easy, but slip-ups happen. Watch out for these:

- Mixing Up Costs: Only include direct costs like materials and labor. Rent or utilities? Those are overhead, not COGS.

- Inaccurate Inventory: Wrong beginning or ending inventory skews results. Regular stock checks prevent this.

- Inconsistent Periods: Match beginning and ending inventory to the same time frame. Mixing months or years causes errors.

- Forgetting Freight Costs: Shipping costs for materials count in COGS. Don’t leave them out.

Using software or a bookkeeper can catch these issues early. Precision matters.

COGS vs. Operating Expenses

COGS isn’t the same as operating expenses. COGS covers direct production costs—think materials or labor for goods sold. Operating expenses? That’s rent, utilities, or marketing. For the jewelry shop, COGS includes gems and labor, but shop rent is an operating expense. Knowing the difference ensures accurate financials.

How to Use COGS

COGS is more than a number—it’s a tool. Here’s how businesses use it:

- Pricing Decisions: High COGS? Consider raising prices or finding cheaper suppliers.

- Inventory Management: Track COGS to avoid overstocking or understocking.

- Profit Analysis: Use COGS to calculate gross profit and assess operational health.

- Budget Planning: Allocate funds based on COGS trends to control costs.

Regular COGS checks keep businesses agile and informed. It’s like a financial compass.

Practical Tips for Tracking COGS

Want to make COGS tracking a breeze? Try these:

- Use Software: Tools like Xero or Zoho Books automate inventory and COGS calculations, saving time and reducing errors.

- Conduct Regular Inventory Checks: Count stock monthly or quarterly to ensure accurate beginning and ending inventory values.

- Keep Detailed Records: Log all purchases and production costs. Organized records make COGS calculations effortless.

- Work with Experts: Accountants can verify COGS and ensure compliance with accounting standards. Peace of mind? Priceless.

Real-World Applications

COGS isn’t just a number—it’s a decision-maker. A jewelry shop might use COGS to switch to cheaper gem suppliers without sacrificing quality.

A subscription box service could analyze COGS to streamline packing processes. By tracking COGS, businesses spot inefficiencies, set smarter prices, and boost profitability. It’s like having a financial detective on the team.

COGS FAQs

Got questions? Here are answers to common COGS queries, keeping things clear and concise.

1. What costs go into COGS?

COGS includes direct costs: raw materials, direct labor, and manufacturing supplies. Exclude indirect costs like rent, utilities, or advertising.

2. Can COGS include labor costs?

Yes, but only labor directly tied to production, like assembly workers’ wages. Administrative or sales staff wages don’t count.

3. How often should COGS be calculated?

Calculate COGS monthly, quarterly, or yearly, based on business needs. Regular calculations help spot cost trends early.

4. What if the ending inventory is zero?

If ending inventory is zero, COGS equals beginning inventory plus purchases. All stock was sold, so no subtraction is needed.

5. Why is COGS different for service businesses?

Service businesses may have minimal COGS, as they don’t produce physical goods. Costs like software or labor may apply instead.

6. How does COGS affect taxes?

COGS reduces taxable income by lowering gross profit. Accurate COGS ensures correct tax reporting and avoids overpayment.

7. Can COGS be negative?

No, COGS can’t be negative. If ending inventory exceeds beginning inventory plus purchases, check for errors in counts or records.

8. What’s the difference between COGS and expenses?

COGS covers direct production costs. Expenses include indirect costs like rent, marketing, or salaries not tied to production.

9. How can a business lower COGS?

Negotiate better supplier deals, streamline production, or reduce waste. Small changes in material costs can significantly impact COGS.

10. Is COGS the same for retail and manufacturing?

Not quite. Retail COGS are mostly purchased goods. Manufacturing includes raw materials, labor, and production costs. Same formula, different inputs.

Wrapping It Up

Calculating COGS is a must for any business serious about profitability. The formula—beginning inventory plus purchases minus ending inventory—is simple yet powerful.

With accurate records and regular checks, businesses gain clarity on costs and make informed decisions. Whether running a jewelry shop or a subscription service, COGS shines a light on what drives success.

The best part? Anyone can do it with the right tools and know-how. So, grab those numbers, crunch them, and watch the business thrive.