Let’s talk about something that might sound like tax lingo but is pretty straightforward once broken down: the IRS 1099 tax form.

Confused about what it is? Who gets it? Why does it matter? No worries.

This guide will walk you through the 1099 tax form, so you can simplify your financial life without wading through a swamp of complex terms.

What’s the IRS 1099 Form?

The IRS 1099 formis a document used to report income you’ve earned outside of a traditional paycheck. Think of it as the IRS’s way of keeping tabs on money flowing to you from sources other than your employer.

Unlike a W-2, which your employer sends to report wages, salaries, or tips, the 1099 captures income from freelance gigs, side hustles, investments, or other non-employee payments.

Why does this matter? The IRS wants to ensure all your income is reported and taxed properly. Simple enough, right?

Who Receives it?

So, who’s on the hook for receiving a 1099? If you’re earning money in certain ways, expect one (or more) to land in your mailbox or inbox. Here’s the breakdown:

- Freelancers and Independent Contractors. Work as a graphic designer, writer, or consultant? If a client pays you $600 or more in a year, they’re required to send you a 1099-NEC (Nonemployee Compensation). This covers your freelance income.

- Gig Workers. Drive for a rideshare app, deliver groceries, or rent out your spare room on a platform like Airbnb? Those platforms often issue a 1099-K to report payments you’ve received.

- Investors. Earn dividends, interest, or sell stocks? You’ll likely get a 1099-DIV for dividends, 1099-INT for interest, or 1099-B for stock sales.

- Retirees or Beneficiaries. Receive distributions from retirement accounts or pensions? A 1099-R will show up to report those.

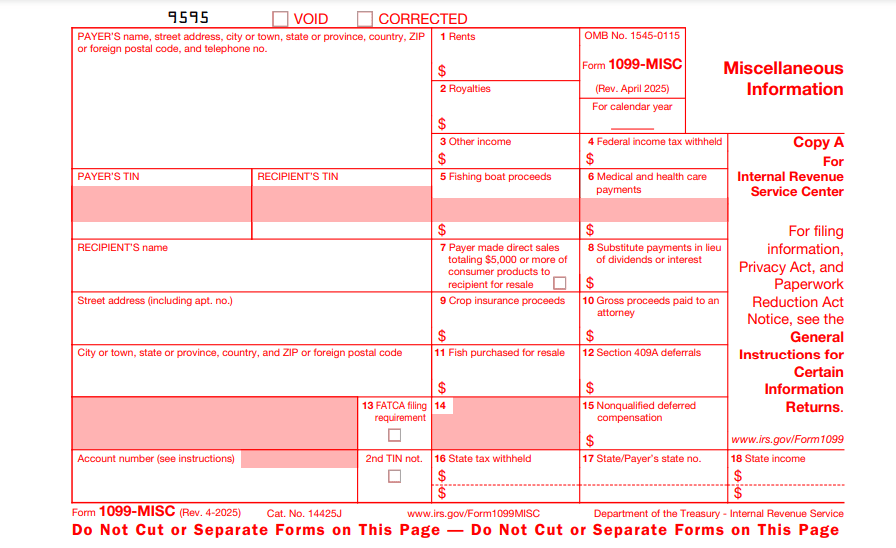

- Miscellaneous Income. Win a prize, receive royalties, or get paid for odd jobs? That’s reported on a 1099-MISC.

The key takeaway? If you’re earning money outside a regular paycheck, there’s probably a 1099 form for that. The IRS has a version for nearly every type of income.

Why do You Get a 1099?

Here’s the deal: 1099 forms exist to track income. When someone pays you for work or services, they’re required to report it to the IRS.

You get a copy, and so does the IRS. This ensures you’re not accidentally (or intentionally) skipping out on reporting income when tax season rolls around.

The good news? These forms make it easier for you to report your earnings accurately. The not-so-fun part? You’re responsible for paying taxes on that income, often without automatic withholding like a traditional job. More on that later.

Types of 1099 Forms

There are over 20 variations of the 1099 form, each tailored to specific types of income. Don’t worry—we won’t list them all. Here are the most common ones you might encounter:

- 1099-NEC: For nonemployee compensation. Think freelance or contract work.

- 1099-K: For payments from third-party platforms like PayPal, Venmo, or rideshare apps.

- 1099-MISC: For miscellaneous income like royalties, prizes, or rent payments.

- 1099-DIV: For dividends from investments.

- 1099-INT: For interest earned from bank accounts or loans.

- 1099-R: For distributions from pensions, annuities, or retirement plans.

- 1099-B: For proceeds from selling stocks or other securities.

Each form has a specific purpose, but they all serve the same goal: reporting your income to the IRS.

Who Sends You a 1099?

The sender depends on the type of 1099. If you’re a freelancer, the client or company paying you issues the 1099-NEC. If you’re selling crafts online, the platform processing your payments (like Etsy or eBay) might send a 1099-K.

Banks, investment firms, or retirement plan administrators issue forms like 1099-INT, 1099-DIV, or 1099-R.

Here’s the catch: Not every payment triggers a 1099. For example, businesses only need to issue a 1099-NEC if they pay you $600 or more in a year.

Smaller amounts? You’re still responsible for reporting that income, even without a form. Sneaky, right?

When Do You Get a 1099?

Expect 1099 forms to arrive by January 31 of the following tax year. For example, income earned in 2025 will be reported on 1099s sent by January 31, 2026.

Most come by mail, but many companies now send digital versions via email or online portals. Keep an eye on your inbox (and spam folder).

Missed a form? Don’t panic. You can contact the payer to request a copy or check your own records to report the income accurately.

1099 Form Importance

Receiving a 1099 means you’re on the hook for reporting that income on your tax return. Unlike a W-2 job, where taxes are withheld from each paycheck, 1099 income often comes with no taxes withheld. That means you might owe a chunk of money when you file your taxes.

Here’s the kicker: If you’re self-employed (think freelancers or gig workers), you also owe self-employment tax (about 15.3% of your net earnings) to cover Social Security and Medicare.

The good news? You can deduct half of that tax, plus business expenses, to lower your tax bill.

How to Handle 1099 Income

Got a 1099? Here’s a simple 3-step plan to stay on top of it:

- Track Your Income. Keep records of all payments, even those under $600. Apps like QuickBooks or a simple spreadsheet can help.

- Set Aside Money for Taxes. Aim to save 20-30% of your 1099 income for taxes. Open a separate savings account to avoid spending it.

- File Accurately. Use the 1099 forms to report income on your tax return (usually Schedule C for self-employed folks). Consider tax software or a professional to avoid mistakes.

The best part? Staying organized makes tax season way less stressful.

A Few Things To Consider

Nobody’s perfect, but dodging these pitfalls can save you headaches:

- Ignoring Small Payments. No 1099 for a $200 gig? You still need to report it.

- Forgetting Self-Employment Tax. That 15.3% can sneak up on you. Plan for it.

- Missing Deadlines. File by April 15 (or October 15 with an extension). Late filings can mean penalties.

- Not Keeping Records. Save receipts, invoices, and 1099s. They’re your proof if the IRS comes knocking.

Note: Consider paying estimated taxes quarterly if you earn a lot of 1099 income. It spreads out the tax burden and avoids a big bill in April.

Special Cases to Know

Some situations make 1099s a bit trickier:

- Gig Economy Platforms. If you earn through apps like Uber or Etsy, you might get a 1099-K. These forms report gross payments, including fees the platform takes. You can deduct those fees on your taxes.

- Multiple 1099s. Work for several clients? You could get a stack of 1099s. Add them all up for your tax return.

- Incorrect Forms. If a 1099 has errors (like wrong income amounts), contact the issuer ASAP to get a corrected version.

Confused yet? Don’t worry. Tax software or a professional can help sort it out.

Why This Matters for Your Financial Life

Understanding the IRS 1099 form empowers you to manage your money better. Whether you’re freelancing, investing, or earning side income, these forms ensure you’re reporting everything correctly.

The upside? You avoid IRS penalties and stay in control of your finances. The downside? Ignoring 1099s can lead to audits or fines. Nobody wants that.

The good news? With a little organization, handling 1099s is doable. Keep track of income, save for taxes, and file on time. Simple steps, big impact.

Wrapping It Up

The IRS 1099 form isn’t as scary as it sounds. It’s just a way to report income from non-traditional sources—freelance work, investments, gig apps, and more.

If you’re earning money outside a regular job, chances are you’ll see one. Stay organized, plan for taxes, and don’t let those forms catch you off guard.

Got questions? A tax professional can help, or check out IRS.gov for free resources. The key? Don’t ignore those 1099s. They’re your ticket to staying on the IRS’s good side.