- Understanding EI Reporting

- Why Go Online for EI Reporting?

- How To Set Up EI Reporting Online?

- What You Need to Report

- Navigating the Online Reporting System

- Avoiding Drawbacks

- Benefits

- Who Can Use Online EI Reporting?

- Can’t Access My Service Canada Account?

- Why EI Reporting Matters?

- A Few Things To Consider

- Future

- Wrapping It Up

Don’t know what EI reporting online is, and wondering how it fits into your life if you’re navigating Canada’s Employment Insurance (EI) system? No need to dig through dense government manuals.

This article breaks it down in a clear, straightforward, and practical way. So, are you ready to get a grasp of EI reporting online, why it matters, and how it works? Let’s barge forward.

Understanding EI Reporting

First things. EI, or Employment Insurance, is Canada’s safety net for workers facing job loss, maternity leave, sickness, or caregiving responsibilities.

To keep those benefits flowing, you need to report regularly to Service Canada. That’s where EI reporting online comes in.

It’s the digital way to submit your biweekly reports. No paper forms. No snail mail. Just a few clicks.

Why does this matter? Simple. Reporting keeps your EI payments on track. Miss a report? Payments stop. Nobody wants that.

Online reporting is fast, efficient, and—let’s be honest—way more convenient than the old-school methods.

The good news? You can do it from your couch. The catch? You need to know the system. Let’s walk through it.

Why Go Online for EI Reporting?

If you’re juggling life—maybe job hunting, caring for family, or recovering from an illness. The last thing you need is a trip to a Service Canada office.

Online EI reporting saves time. Saves hassle. Here’s why it’s worth your attention:

- Convenience. Report anytime, anywhere. Got internet? You’re set.

- Speed. Submitting online is quicker than mailing paper forms. Payments process faster.

- Accuracy. The system guides you. Fewer mistakes, less back-and-forth.

- Accessibility. Available 24/7. No office hours to worry about.

Not only does online reporting save you time, but it also reduces stress. No wondering if your form got lost in the mail. The system confirms your submission instantly. Done and done.

How To Set Up EI Reporting Online?

Ready to report online? First, you need a My Service Canada Account (MSCA). This is your gateway to EI reporting and other government services. Setting it up is straightforward. Here’s how:

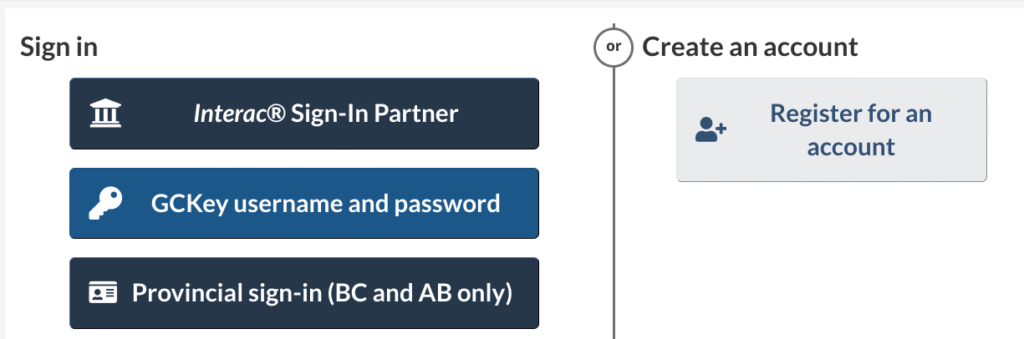

- Visit the Service Canada website. Head to the MSCA login page.

- Sign in or register. Use your Government of Canada login credentials (like GCKey or a banking partner). No account? Create one. It takes minutes.

- Link your EI claim. You’ll need your Social Insurance Number (SIN) and EI access code from Service Canada.

- Set up security. Add two-factor authentication. Keeps things safe.

Got your account? Great. Now you’re ready to report. The MSCA dashboard is user-friendly. It guides you step-by-step—no tech genius required.

What You Need to Report

Every two weeks, Service Canada wants to know what’s going on. Why? To confirm you’re still eligible for EI benefits. Here’s what you’ll report online:

- Work and earnings. Did you work? How much did you earn? Be honest. Even part-time gigs count.

- Availability. Were you ready and able to work? If not, explain why.

- Training or courses. Are you taking classes? Report them. Some programs need approval.

- Other income. Pensions, severance, or other payments? Declare them.

- Travel. Left Canada? You need to report that too.

The questions are clear. Answer them accurately. The system flags inconsistencies, so double-check your entries. Mistakes can delay payments. Nobody’s got time for that.

Navigating the Online Reporting System

Logging into MSCA feels like stepping into a digital checklist. The interface? Clean. Simple. You’ll see a section for EI reporting.

Click it, and the system walks you through the questions. Each one is multiple-choice or short-answer. No essay required.

Here’s a pro tip. Keep records handy, pay stubs, work hours, or course schedules. Having them ready makes reporting a breeze. Most people finish in 5-10 minutes.

The system saves your progress, so if you get interrupted—life happens—you can pick up where you left off.

Worried about typos? Don’t be. The platform highlights missing answers before you submit. It’s like a built-in proofreader.

Once you hit submit, you get a confirmation number. Save it. It’s your proof of reporting.

Avoiding Drawbacks

Nobody’s perfect. Mistakes happen. But with EI reporting, errors can mess with your payments. Here are common slip-ups and how to dodge them:

- Missing deadlines. Reports are due every two weeks. Set a calendar reminder. The MSCA often shows your next due date.

- Inaccurate earnings. Underreporting or overreporting income? Bad idea. Double-check your numbers. Use pay stubs or bank statements.

- Forgetting to report absences. Left the country? Took a course? Report it. Service Canada needs to know.

- Tech troubles. Slow internet or browser issues? Try a different device or browser. Chrome and Firefox work best.

The good news? Most issues are fixable. If you mess up, contact Service Canada ASAP. They’re there to help. But avoiding these pitfalls saves you the headache.

Benefits

Online EI reporting isn’t just about ease. It’s about staying in control. You get real-time updates on your claim status. Payment dates. Amounts. All is visible in your MSCA. No waiting for mailed letters. Plus, it’s eco-friendly. Less paper, less waste.

Another perk? Security. Online reporting uses encrypted systems. Your data stays safe. Compare that to paper forms floating through the mail.

Not only is online reporting faster, but it’s also more secure. Peace of mind? Priceless.

Who Can Use Online EI Reporting?

Almost everyone on EI can report online. Whether you’re on regular benefits, maternity, parental, sickness, or caregiving EI, the system works for you.

The only catch? You need internet access and an MSCA. No internet? Service Canada offers a telephone reporting option. But online is the way to go for most.

Got accessibility needs? The MSCA is designed with inclusivity in mind. Screen readers and keyboard navigation are supported. If you hit barriers, Service Canada’s helpline can guide you.

Can’t Access My Service Canada Account?

Sometimes, things don’t go smoothly. Maybe you can’t log in. Or the system flags an error. What then? Don’t panic. Here’s what to do:

- Check your login. Wrong password? Reset it. Locked out? Follow the MSCA recovery steps.

- Review your report. Errors flagged? Go back and fix them. The system points out what’s wrong.

- Contact Service Canada. Call 1-800-206-7218. Have your SIN and EI access code ready. They’ll sort it out.

The MSCA also has a help section. FAQs, guides, and tips. Most questions are answered there. Still stuck? Service Canada’s staff are trained to assist. Patience helps—they’re busy, but they’ll get to you.

Why EI Reporting Matters?

Reporting isn’t just a hoop to jump through. It’s how Service Canada ensures benefits go to those who qualify. Think of it as a check-in.

You’re proving you still meet the rules. Skimp on reporting? Payments pause. Worse, you might owe money back if you’re overpaid.

Honesty is key. Declaring all earnings and activities keeps you compliant. The system’s designed to catch discrepancies, so don’t try to game it. Transparency saves trouble.

A Few Things To Consider

Want to make reporting a breeze? Try these:

- Schedule it. Pick a day every two weeks. Make it routine.

- Stay organized. Keep a folder—digital or physical—for pay stubs, schedules, and confirmation numbers.

- Double-check. Review your answers before submitting. Accuracy matters.

- Stay informed. Check MSCA for updates on your claim. New messages from Service Canada show up there.

The better your system, the less stress you’ll feel. Reporting becomes second nature.

Future

EI reporting online is part of a broader shift. Governments are going digital. Why? Efficiency. Accessibility. Canada’s EI system is no exception. Online reporting streamlines a process that used to be clunky. Paper forms? Phone queues? They’re fading fast. Digital is the future.

This matters for you. Mastering online reporting isn’t just about EI. It’s about navigating a world where digital tools are king. Get comfortable now, and you’re set for whatever comes next.

Wrapping It Up

So, what is EI reporting online? It’s your ticket to managing EI benefits without the hassle. Fast. Secure. Convenient.

By setting up an MSCA, answering a few questions every two weeks, and staying organized, you keep your benefits flowing. No stress. No fuss.

The best part? You’re in control. Check your claim status. Track payments. All from your device. Got questions? Service Canada’s got your back.

Ready to start? Head to the MSCA website and set up your account. Reporting’s never been easier.