How do you ensure every cent is accounted for? When you’re running a company or a business, juggling sales, bills, and profits. This is where the Accounting Equation comes into play.

It is like your financial GPS, balancing what you own with what you owe and what’s yours. Born in the 15th century with Luca Pacioli’s double-entry bookkeeping, it’s been the bedrock of accounting ever since.

Using it can help your books be error-free, guide smart choices, and work for any business—big or small. So let’s tap into the article to know about it comprehensively.

What Is the Accounting Equation (The Formula)?

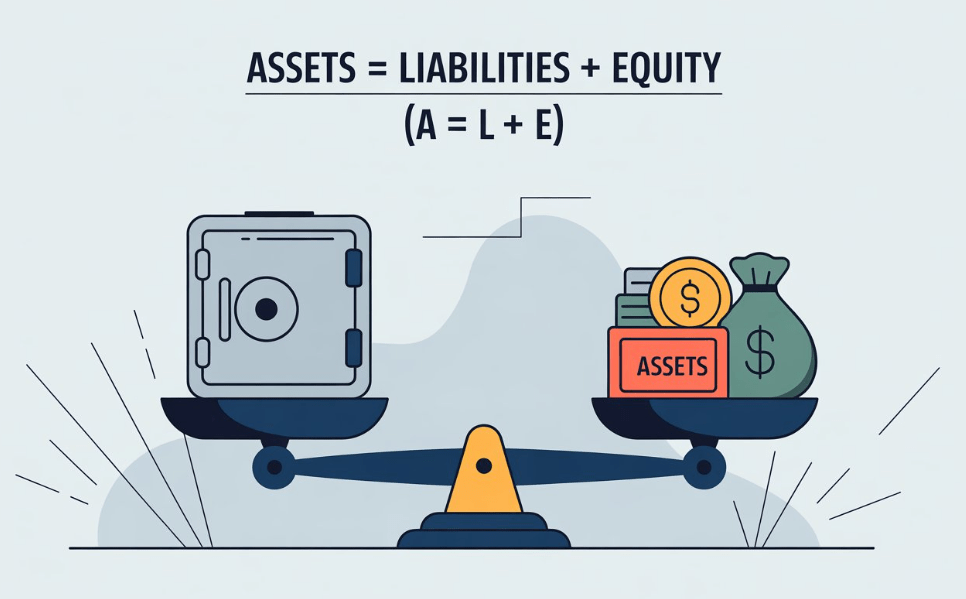

You can think Accounting Equation as the backbone of financial records. At its core? Assets = Liabilities + Equity. Simple, right? But this formula keeps everything in balance.

We’ll break it down step by step, so you can grasp how it works in everyday business scenarios.

Why does this matter to you? Whether you’re running a small tech startup or managing personal finances, understanding this equation helps track what you own and owe.

Not only does it reveal a company’s financial health, but it also guides decisions on growth and investments.

The Basics

Starting with the fundamentals. The accounting equation shows the relationship between what a business owns, what it owes, and the owner’s stake. Assets on one side. Liabilities and equity on the other. They must always balance — that’s the rule.

Imagine you run a retail store. You buy inventory—that’s an asset, borrow money to fund it – That’s a liability. Your initial investment is equity. Balancing these keeps the books accurate.

Gerunds like recording transactions or analyzing statements make this process dynamic. We use this equation not only to maintain records but also to spot trends over time.

Explaination

Let’s dive a bit deeper now. We’ll explore each component. What do they mean? How do they interact, and why must they stay in equilibrium?

Assets: What You Own

Assets are resources with economic value. Think cash, equipment, or inventory. Current assets? Things you can convert to cash quickly, like accounts receivable. Long-term assets? Property or patents that stick around.

The key point? Assets drive operations. Without them, business grinds to a halt. For instance, a software company might list servers as assets. Or a manufacturing firm counts machinery.

Assets don’t just help you make money today — they’re what build your future value. Keeping track of them means you always know what you’re really worth.

Liabilities: What You Owe

Liabilities represent obligations. Debts to suppliers, loans from banks, or unpaid wages. Short-term? Payables due soon. Long-term? Mortgages or bonds.

Why track these? To avoid surprises. High liabilities might signal risk, but they can fund growth too. Balancing act, isn’t it?

In practice, when you take a loan, liabilities rise—but so do assets if you use the cash wisely.

Equity: The Owner’s Share

Equity is what’s left after subtracting liabilities from assets. Owner’s capital, retained earnings, or stock issuances. It reflects your stake in the business.

You build equity through profits or investments and reduce it through Withdrawals or losses. Not only does equity show ownership, but it also measures performance over time.

Gerunds such as investing wisely or retaining profits highlight how equity grows.

How the Equation Works

Putting it all together. Every transaction affects the equation. If you buy equipment on credit, your Assets go up, liabilities go up. And sell goods for cash, your Assets shift—from inventory to cash—while equity might increase via profit.

The beauty? It always balances. Double-entry bookkeeping ensures that. Debit one side, credit the other.

Rhetorical question: Ever wondered why books “balance”? This equation is the reason.

We see this in action during financial reporting. Balance sheets rely on it entirely.

Impacts of Transactions

- Investments: You add cash—asset increases, equity rises.

- Loans: Borrow funds—assets up (cash), liabilities up.

- Expenses: Pay rent—assets down (cash out), equity down (via reduced profits).

- Revenues: Earn from services—assets up (receivables or cash), equity up.

These shifts keep everything aligned.

Examples

Time for real-world scenarios. We’ll use a consulting firm and a construction company. No fluff—just clear cases.

Consulting Firm Startup (Table)

| Step | Transaction Description | Cash | Furniture | Total Assets | Liabilities | Equity | Explanation |

|---|---|---|---|---|---|---|---|

| 1 | Invest $50,000 from savings | 50,000 | 0 | 50,000 | 0 | 50,000 | Initial investment: Cash increases, equity increases. |

| 2 | Buy office furniture for $10,000 cash | 40,000 | 10,000 | 50,000 | 0 | 50,000 | Asset swap: Cash ↓, Furniture ↑, total assets unchanged. |

| 3 | Take out $20,000 loan for marketing | 60,000 | 10,000 | 70,000 | 20,000 | 50,000 | Loan increases both cash and liabilities. |

| 4 | Earn $15,000 from client (cash) | 75,000 | 10,000 | 85,000 | 20,000 | 65,000 | Revenue increases cash and equity (profit). |

| 5 | Pay $5,000 in utilities (expense) | 70,000 | 10,000 | 80,000 | 20,000 | 60,000 | Expense reduces cash and equity (net income decreases). |

Final Balances:

- Assets: $70,000 (cash) + $10,000 (furniture) = $80,000

- Liabilities: $20,000

- Equity: $60,000

- Equation: Assets ($80,000) = Liabilities ($20,000) + Equity ($60,000)

Construction Company Expansion (Table)

Here’s another accounting table for the construction firm. We’ll track how each transaction affects Assets, Liabilities, and Equity — all based on the accounting equation:

| Step | Transaction Description | Cash | Tools | Total Assets | Liabilities | Equity | Explanation |

|---|---|---|---|---|---|---|---|

| 1 | Initial investment of $100,000 | 100,000 | 0 | 100,000 | 0 | 100,000 | Cash increases; equity reflects owner’s investment. |

| 2 | Buy $30,000 tools on credit | 100,000 | 30,000 | 130,000 | 30,000 | 100,000 | Tools added as assets; liability increases (no cash spent). |

| 3 | Complete project, earn $50,000 in cash | 150,000 | 30,000 | 180,000 | 30,000 | 150,000 | Revenue increases cash and equity (profit). |

| 4 | Repay $10,000 of the credit | 140,000 | 30,000 | 170,000 | 20,000 | 150,000 | Cash decreases; liabilities decrease. |

| 5 | Issue new shares for $40,000 | 180,000 | 30,000 | 210,000 | 20,000 | 190,000 | Cash increases; equity increases (new capital injection). |

Final Balances:

- Assets: $180,000 (cash) + $30,000 (tools) = $210,000

- Liabilities: $20,000

- Equity: $190,000

- Accounting Equation Check:

Assets ($210,000) = Liabilities ($20,000) + Equity ($190,000)

Advanced Applications

In corporations, equity isn’t just a single number — it includes things like common stock, preferred stock, and sometimes treasury stock (which is stock the company buys back).

For nonprofits, equity is often referred to as net assets, but the concept is similar — it represents what the organization truly owns after covering all its obligations.

This basic accounting equation isn’t just for small business owners or startups. It’s a core financial tool used by large corporations, analysts, and investors. In mergers and acquisitions, for example, it plays a critical role in understanding the value of each company involved.

What’s more? You can use the same equation to forecast future financial positions, simply by plugging in projected numbers for income, expenses, loans, and investments.

FAQs

The formula stays the same, but values fluctuate with transactions.

No. You can apply it to personal finances, too. Assets like savings, liabilities like loans, and equity as net worth.

Depreciation reduces assets (equipment value) and equity (via expense) and keeps the balance.

It ensures accuracy. Every transaction hits two accounts.

The equation is the principle, and the balance sheet is the statement showing it.

Yes, if liabilities exceed assets, it indicates insolvency.

Links the balance sheet to the income statement and cash flow.

Wrapping Up

There you have it. The accounting equation—Assets = Liabilities + Equity—simplifies complex finances. We’ve covered the components, how it works, examples from consulting and construction, and tips to avoid mistakes.

The best part? Applying this builds confidence in handling money matters. Whether you’re just starting out or scaling up, this foundation supports smart choices.