Equity is a term we often hear in boardrooms, financial discussions, and startup pitches. But what does it really mean? Whether you’re an entrepreneur, investor, or simply curious about financial concepts, understanding equity is essential.

It’s the foundation of ownership, wealth-building, and shared value in businesses and investments. In this article, you’ll explore what equity is, its formula, real-life examples, and more. So without any further ado, let’s jump right in.

Defining Equity

Equity represents ownership in an asset or company after accounting for debts or liabilities. Think of it as your stake in something valuable—be it a business, property, or investment portfolio.

It’s the portion you truly own, free from obligations. In essence, equity reflects the net value tied to your ownership.

For businesses, equity is the value of the company’s assets minus its liabilities. For individuals, it might mean the portion of a home or investment you own outright, after subtracting any loans or debts.

Simple enough, right? Yet, equity’s implications stretch far beyond this basic definition, touching everything from startup funding to personal wealth.

Why Equity Matters

Why should you care about equity? It’s more than just numbers on a balance sheet. Equity signifies control, potential profit, and financial stability.

For business owners, it’s the value of their hard work. For investors, it’s a share of future growth. For homeowners, it’s the wealth built over years of mortgage payments.

Understanding equity helps you make informed decisions—whether you’re launching a company, investing in stocks, or buying property.

It’s worth noting that Equity isn’t static, as it grows or shrinks based on performance, market conditions, or debt repayment.

Grasping this dynamic nature empowers you to strategize effectively. Ready to dig deeper? Let’s break down the formula.

The Formula

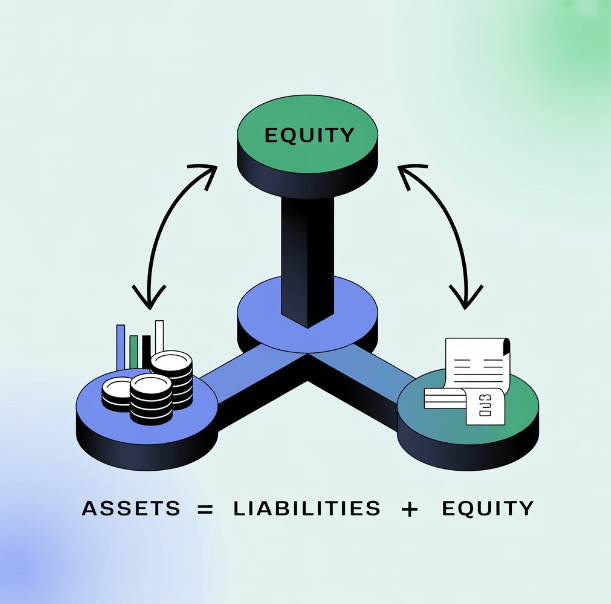

Calculating equity is straightforward. The formula is:

Equity = Assets – Liabilities

- Assets: Everything of value owned. For a business, this includes cash, inventory, property, or intellectual property. For an individual, it might be a home, a car, or investment accounts.

- Liabilities: Debts or obligations owed. Think loans, mortgages, or unpaid bills.

This formula applies universally, whether you’re assessing a multinational corporation or your personal finances. Want to see it in action? Let’s explore an example.

Examples

1. Startup Funding

You’re launching a tech company. To raise capital, you sell 20% of your business to an investor for $100,000.

Your company’s total value (based on the investment) is now $500,000. If your liabilities are $50,000, your equity is:

Equity = $500,000 (Assets) – $50,000 (Liabilities) = $450,000

Your 80% ownership is worth $360,000, while the investor’s 20% stake is worth $90,000. As the company grows, so does the equity for both parties.

This is why startups chase equity financing—it ties growth to ownership value.

2. Personal Finance

Stock Portfolio & Equity Summary

| Scenario | Assets | Liabilities | Equity | Explanation |

|---|---|---|---|---|

| Initial Investment | $50,000 | $10,000 | $40,000 | $50,000 portfolio value minus $10,000 loan |

| Portfolio Value Increases | $60,000 | $10,000 | $50,000 | Asset growth boosts equity |

| Loan Paid Off (No Liabilities) | $60,000 | $0 | $60,000 | No debt = full asset value becomes equity |

Increasing asset value or reducing debt directly boosts your equity. This is a key principle in both personal finance and investment strategy.

3. Corporate World

In large corporations, shareholders’ equity is key. If a company has $1 billion in assets and $400 million in liabilities, its equity is $600 million.

This value is divided among shareholders. If the company issues 1 million shares, each share represents a slice of that $600 million.

Rising profits or asset values increase equity, driving up share prices. This is why investors watch equity closely—it signals a company’s health.

Types of Equity

Equity isn’t one-size-fits-all. It takes different forms depending on the context. Here are the main types you should know:

- Owner’s Equity: Common in small businesses or sole proprietorships. It’s the owner’s share of the business after liabilities are paid.

- Shareholders’ Equity: Found in corporations. This is the total value of assets minus liabilities, distributed among shareholders based on their stock ownership.

- Home Equity: The portion of a property’s value you own, minus any mortgage or loans against it.

- Brand Equity: Less tangible but vital. This refers to the value of a brand’s reputation, customer loyalty, or market position. Think of companies like Apple or Nike—not only do they have financial equity, but their brand itself holds immense value.

Each type serves a unique purpose. Whether you’re running a business or buying a home, recognizing these distinctions helps you navigate financial decisions.

How To Build Equity?

Want to grow your equity? Here are actionable strategies:

- Reduce Liabilities: Pay down debts like loans or mortgages. Less debt means more equity.

- Increase Asset Value: For businesses, invest in growth—new products, marketing, or innovation. For personal assets, maintain or improve property to boost its market value.

- Monitor Market Trends: Equity fluctuates with market conditions. Stay informed to anticipate changes in asset values.

- Diversify Investments: Spread assets across stocks, real estate, or businesses to balance risk and grow equity over time.

Building equity takes patience and strategy. But the payoff? Greater financial security and ownership value.

Equity vs. Equality

Don’t confuse equity with equality. Equity is about ownership and financial value. Equality refers to fairness or sameness in treatment or resources.

For example, giving two employees the same salary promotes equality, but dividing company shares based on contribution reflects equity. Mixing these up can muddy financial discussions, so keep them distinct.

Equity FAQs

Equity focuses on a specific asset or entity (like a business or home) and is calculated as assets minus liabilities.

Net worth is broader, encompassing your total assets minus total liabilities across all your holdings. In short, equity is a piece of the net worth puzzle.

Yes. If liabilities exceed assets, equity becomes negative. For example, if a business owes $500,000 but has only $400,000 in assets, its equity is -$100,000. This signals financial trouble, often requiring intervention.

Equity itself isn’t taxed, but realizing equity—such as selling a home or shares—can trigger capital gains taxes. Consult a tax professional to understand your specific situation, as tax rules vary.

Startups often lack cash to pay high salaries, so they offer equity (stock options) to attract talent. Employees gain a stake in the company’s future growth, aligning their interests with the business’s success.

Pay down your mortgage faster, make home improvements to boost property value, or wait for market appreciation. Each step increases the gap between your home’s value and your debt.

Wrapping Up

As we know, equity is more than a financial term—it’s a measure of ownership, value, and opportunity. Whether you’re calculating the worth of a business, assessing your home’s value, or investing in stocks, the formula remains simple: Assets minus Liabilities.

Yet, its impact is profound. By reducing debt, growing assets, and staying informed, you can build equity over time.

Not only does this strengthen your financial position, but it also opens doors to new possibilities. From startups to personal investments, equity is the key to understanding what you truly own.