- What is EFTPS?

- How To Make an EFTPS Payment? Guide

- Online Website

- Via Phone Voice Response System

- Same-Day Payments

- Batch Payments

- Recurring

- EFTPS Benefits

- Who Can Use EFTPS?

- Eligibility Requirements

- How to Set Up an EFTPS Account?

- Enrollment

- Activation

- Making Your First Payment

- Tips to Make Payments Smoothly

- Common Payment Issues

- Login Troubles

- Rejected Payments

- System Maintenance

- Wrapping It Up

Dealing with federal tax payments can feel overwhelming at first. With deadlines looming and the need for accuracy, finding a reliable system makes all the difference.

Over the years, I have assisted numerous clients in setting up and using online payment methods, easing their stress during tax season.

From handling individual estimated taxes to managing business payroll obligations, I have seen how a straightforward tool can transform the process.

Drawing from these encounters, I understand the common hurdles and the relief that comes with a secure, efficient solution.

In this article, I’ll walk you through the essentials of EFTPS, sharing insights to help you get started smoothly.

What is EFTPS?

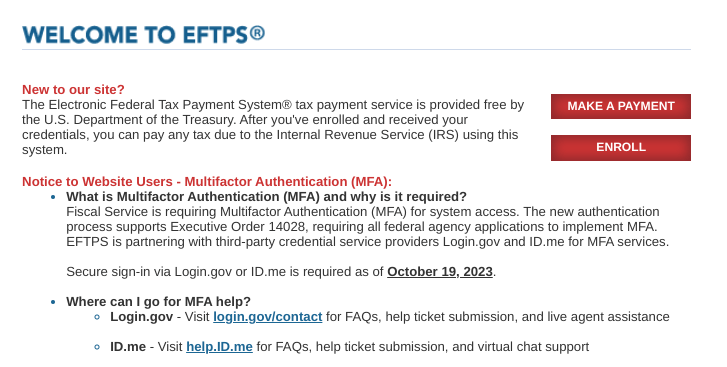

EFTPS stands for the Electronic Federal Tax Payment System. This free service comes from the U.S. Department of the Treasury. You can use it to pay federal taxes at any time, day or night.

Think about paying taxes without rushing to the post office, or avoiding late fees because you scheduled everything ahead of time. That’s what EFTPS offers.

You access it online or by phone, no extra costs involved. And businesses and individuals both benefit from this setup. Scheduling payments becomes simple, whether for quarterly estimates or monthly withholdings.

From experience, many find the 24/7 availability a real lifesaver during busy periods. You must enroll first, but once you’re done, making payments becomes a routine task.

How To Make an EFTPS Payment? Guide

EFTPS offers a range of payment methods to fit different needs, whether you’re a small business owner, a freelancer, or an individual taxpayer.

Below, all the ways you can make payments are outlined, drawn from real-world use and IRS guidelines. Each option is designed for flexibility, but knowing the nuances can help you pick the right one.

Online Website

The most common way to use EFTPS is through its website, www.eftps.gov. Once you’re enrolled (more on that later), you can log in and make payments in a few clicks. Here’s how it works:

- Select Tax Type: Choose the tax form, like Form 1040 for individual income taxes or Form 941 for payroll taxes.

- Enter Payment Details: Input the amount, payment date, and bank account info.

- Schedule or Pay Now: You can pay immediately or schedule up to 120 days in advance.

This option is ideal for those who like control. You can log in from your laptop at 2 a.m. if that’s when inspiration strikes.

A client once scheduled quarterly payments while on vacation, avoiding a last-minute rush. Just ensure your bank account has sufficient funds—rejections due to low balances are a hassle, as I learned when a payment bounced because of an oversight.

Via Phone Voice Response System

Don’t want to deal with a computer? You can use the EFTPS Voice Response System by calling 1-800-555-4477. It’s available 24/7 and guides you through prompts to make a payment. You’ll need:

- Your EFTPS PIN (mailed during enrollment).

- The TIN (SSN or EIN) and tax type.

- Bank account details for the payment.

This is great for those who prefer verbal instructions or lack reliable internet. But heads-up: double-check your entries, as there’s no screen to review.

Same-Day Payments

Missed a deadline or underpaid? EFTPS allows same-day payments to cover urgent situations. You must initiate these by 8 p.m.

ET the day before the IRS deadline for the funds to process on time. This option saved the day when a last-minute calculation error required a quick additional payment. It’s not only convenient but also a lifesaver for avoiding penalties.

To use this, log in or call, select the tax type, and choose the “same-day payment” option. Ensure your bank account is ready, as these transactions pull funds immediately.

Batch Payments

If you’re running a business with multiple tax types—like payroll, excise, or corporate taxes—EFTPS supports batch payments.

This lets you submit multiple payments in one session, streamlining the process. For example, small business owners can use batch payments to handle payroll and estimated taxes in one go, and cut their admin time in half.

To set this up, use the EFTPS “Batch Provider” software, downloadable from the website. It’s tailored for businesses or tax professionals managing multiple clients.

You’ll need to upload a file with payment details, which EFTPS processes in bulk. Just verify each entry—mixing up tax types can lead to misallocated funds, as happened to a client early on.

Recurring

For taxes like quarterly estimated payments, EFTPS lets you set up recurring payments. You can schedule these to repeat automatically—say, every three months for Form 1040-ES.

This is a game-saver for self-employed folks or businesses with regular tax obligations. If you’re a Freelancer, you can set up recurring payments and never miss a deadline again, freeing up mental space for your work.

To configure this, log into EFTPS, select “Schedule Payment,” and choose the recurring option. Specify the frequency, amount, and start date. Be sure to review periodically, as tax liabilities can change.

EFTPS Benefits

- Schedule payments – Up to 365 days in advance for individuals or 120 days for businesses. Not only does this help avoid penalties, but it also enables you to plan your cash flow more effectively.

- Robust Security – It stands out as another key advantage. Your information stays protected with multiple authentication steps. You can review payment history for up to 16 months, keeping records straight.

- Convenience – You can pay from home or while traveling. No need for checks or stamps. You receive confirmation numbers for each transaction, providing peace of mind.

- Supports Various Taxes – EFTPS works for various tax types. From income to employment taxes, you cover them all in one place. International users with U.S. bank accounts can join as well.

- Time Saver – You save time since the system handles debits automatically on the chosen date. Avoiding manual errors, because the IRS receives exact details.

Who Can Use EFTPS?

EFTPS is built for a wide range of taxpayers, from individuals to corporations. Here’s a detailed look at who can use it, based on IRS guidelines and practical experience.

- Individuals with Estimated Taxes: If you’re paying quarterly estimated taxes, EFTPS is a lifesaver. You can schedule payments up to 365 days in advance, aligning with deadlines (April 15, June 15, September 15, January 15). A freelancer can find this perfect for managing irregular income without missing due dates.

- Businesses Handling Payroll: Companies with payroll obligations, like Form 941 taxes, can use EFTPS regularly. It streamlines recurring payments, saving time.

- Users of Payroll Services: Even if you employ a payroll service, enrolling in EFTPS gives you oversight. You can check if payments are processed correctly, ensuring compliance. When a client switched payroll providers, their EFTPS account let them verify every transaction seamlessly.

- International Taxpayers: Got a U.S. bank account? International taxpayers qualify, too. Qualified intermediaries can assist with specific payments, like withholding taxes. A colleague abroad used EFTPS for their U.S.-based business, simplifying cross-border compliance.

- Small Businesses, Freelancers, and Corporations: Whether you’re a sole proprietor, a freelancer, or running a large corporation, EFTPS fits. You need an Employer Identification Number (EIN) or Social Security Number (SSN) to enroll. The system scales to your needs, from one-off payments to complex payroll schedules.

Eligibility Requirements

- Taxpayer Identification Number (TIN): You need an Employer Identification Number (EIN) for businesses or a Social Security Number (SSN) for individuals to enroll.

- U.S. Bank Account: A valid U.S. bank account with routing and account numbers is required for payments. International taxpayers must also have a U.S. bank account.

- IRS Verification: Your information must be validated with the IRS during enrollment to ensure accuracy and security.

- Contact Information: Accurate contact details are needed for receiving the mailed PIN and payment confirmations.

- Internet or Phone Access: You must have access to the internet for online payments or a phone for the Voice Response System to use EFTPS.

How to Set Up an EFTPS Account?

Before you can use any of these methods, you need an EFTPS account. The setup is simple but takes a few days, so don’t wait until the last minute. Here’s the process:

Enrollment

Go to www.eftps.gov and click “Enroll.” You’ll provide:

- Taxpayer Identification Number (TIN): SSN for individuals, EIN for businesses.

- Banking Info: Routing and account numbers.

- Contact Details: Accurate info ensures you receive the PIN.

The IRS mails a PIN within 5–7 business days to verify your identity. This step is critical for security, but it can be time-consuming.

Activation

Once you get the PIN, log in to activate your account. Create a password and confirm your bank details. A typo here can cause a payment issue, so double-check everything.

Making Your First Payment

With the account active, you can use any of the payment options above. Log in or call, select the tax type, and enter the payment details. You’re now ready to pay taxes with ease.

Tips to Make Payments Smoothly

From years of using EFTPS, a few strategies stand out to keep things hassle-free:

- Schedule Early: Set payments at least a week before the deadline. The 8 p.m. ET cutoff the day before is strict, and missing it can mean penalties.

- Track Everything: EFTPS provides payment history, but keep your own records. A spreadsheet saved hours during an audit by having all confirmations organized.

- Verify Tax Types: Picking the wrong form (like Form 941 instead of 1040) can misdirect funds. A client faced this, and correcting it was a pain.

- Check Bank Funds: Ensure your account has enough money. Rejected payments due to insufficient funds are a common snag.

Common Payment Issues

Even with EFTPS’s reliability, things can go wrong. Here’s how to handle frequent issues:

Login Troubles

Forgot your PIN or password? Use the “Forgot Password” feature online, but expect a mailed replacement PIN. Store credentials in a secure password manager to avoid this.

Rejected Payments

Incorrect bank details or low funds can cause rejections. EFTPS emails you if this happens. Resubmit quickly to avoid penalties. Verifying account numbers upfront prevents this headache.

System Maintenance

EFTPS occasionally goes offline for updates. Check the website for scheduled downtime and plan payments around it. Missing a deadline because of maintenance won’t excuse you with the IRS.

Wrapping It Up

EFTPS is a powerful tool to simplify federal tax payments, offering flexibility through online, phone, same-day, batch, and recurring options.

By enrolling early, choosing the right method, and staying organized, you can dodge penalties and reduce stress. Whether you’re a solo freelancer or running a business, these payment options put you in control. Get started with EFTPS today, and streamline your tax season.