- What is Average Cost

- Types of Average Costs

- Why Average Cost Matters in Decision-Making

- The Formula for Average Cost

- Examples

- A Few Things to Consider

- Practical Tips

- FAQs

- What Are Fixed and Variable Costs?

- Why does Average Cost matter?

- Does Average Cost Change?

- Average Cost vs. Marginal Cost?

- How Does It Apply Across Industries?

- How Can Small Businesses Use AC?

- Are There Tools for Calculations?

- Can It Help Budget Planning?

- Wrapping it up

Did you know that if a business doesn’t calculate the average cost can lose millions annually? Or that a simple tweak in production can slash per-unit costs by half?

From pricing missteps costing market share to efficiency gains boosting profits, average cost is a game-changer.

In this article, I’ll walk you through its definition, formula, and practical examples to show you how to use it effectively.

What is Average Cost

In a nutshell, it’s the cost of producing each unit calculated by dividing the total cost by the total number of units produced.

So, when you run a manufacturing operation, you can use it to help gauge efficiency over time.

It covers not just materials and workers’ pay but also fixed costs, like rent, that stay the same no matter how much you make.

You think of average cost as a quick look at how your money is spread across what you make.

For instance, making more items spreads fixed costs, like rent, over them, lowering the cost per item—a trick called economies of scale.

But if you make too much too fast, things can get messy, like running out of space, causing higher costs—called diseconomies.

Types of Average Costs

When you break it down further, it shows distinct categories. Average fixed cost covers expenses that remain constant, such as rent or insurance, divided by output quantity.

As you produce more, this value decreases, illustrating why scaling up can lower per-unit burdens.

Then comes average variable cost, which fluctuates with production levels, incorporating items like raw materials or utilities. Monitoring this helps identify points where additional output becomes less economical.

Finally, the average total cost combines both fixed and variable elements, providing a comprehensive view. You must consider all these when planning budgets, since ignoring one could distort the overall picture.

Why Average Cost Matters in Decision-Making

Businesses rely on the average cost for pricing decisions. Setting prices above this threshold ensures profitability, while dipping below might signal a need for cost-cutting measures.

Consider how fluctuations in supplier prices affect variable components, prompting adjustments in operations.

In competitive markets, understanding this metric allows for strategic positioning. You can benchmark against industry standards, identifying areas for improvement.

Such insights, derived from careful analysis, foster sustainable growth without unnecessary risks.

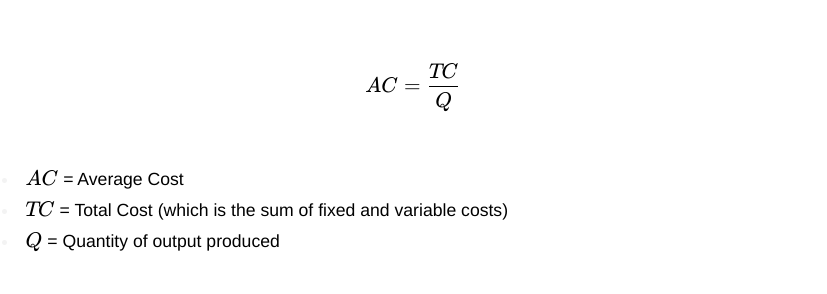

The Formula for Average Cost

Explaination

The formula for average total cost is simple: divide total money by the number of items produced. It’s written as ATC = TC / Q, where ATC is the average total cost, TC is the total cost, and Q is the quantity.

Use this formula in all kinds of situations, but make sure the data is spot-on. Collecting accurate total cost numbers, including both fixed and variable expenses, is the key starting point.

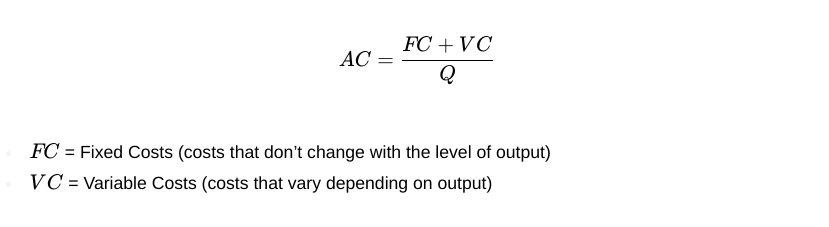

Breaking Down the Components

Total cost splits into two parts: fixed and variable. Fixed costs stay the same no matter how much you make, like rent or full-time salaries. Variable costs change with production, like hourly wages or machine fuel.

Put them together in the formula: ATC = (FC + VC) / Q, where FC is fixed costs, VC is variable costs, and Q is quantity. This split helps spot what’s pushing the average total cost up or down.

Calculating Average Fixed and Variable Costs

To find the average fixed cost, use AFC = FC / Q. As quantity (Q) increases, AFC shrinks, showing why making more can save money.

For average variable cost, use AVC = VC / Q. It often makes a U-shape on graphs—starting high from early hiccups, dropping as things run smoothly, then climbing again when you hit production limits.

Sometimes, you should chart these costs. Graphs make trends clear, helping decide when to ramp up or scale back without getting lost in complicated details.

Advanced Variations in Formulas

Sometimes, looking at marginal cost alongside average cost gives a clearer picture. Average cost covers all units made, but marginal cost shows the cost of just one more unit. Where they meet points to the most efficient production size.

You can also tweak calculations for things like time. Inflation or busy seasons might push up variable costs, changing the average.

For example, during holidays, material costs could jump. Adjusting the formula for these shifts keeps it useful in ever-changing situations.

Examples

Manufacturing Sector Example

Consider a factory producing smartphones. Suppose fixed costs total $100,000 monthly, covering facility maintenance and administrative salaries. Variable costs amount to $200 per unit for components and assembly.

If producing 1,000 units, the total cost reaches $300,000. Thus, the average total cost equals $300 per smartphone.

Scaling to 2,000 units keeps fixed costs the same but doubles variables to $400,000, making the total $500,000 and the average $250 per unit.

You can see the drop, highlighting efficiency gains. However, if output hits 5,000 units and variables rise disproportionately due to overtime pay, the average might climb back up. Monitoring this prevents overextension.

Service Industry Illustration

Shift to a consulting firm offering advisory services. Fixed costs include office rent at $50,000 annually and software subscriptions. Variable costs involve travel expenses and consultant hours, averaging $150 per client engagement.

For 100 clients yearly, the total variables sum to $15,000, plus fixed, equaling $65,000. Average cost per client: $650. Doubling clients to 200 reduces the average to $325, as fixed spreads thinner.

Yet, quality might suffer if consultants overload, increasing errors and rework costs. You must balance volume with service standards, using average cost as a guidepost.

Retail Business Scenario

Imagine operating an online store selling apparel. Fixed costs encompass website hosting and marketing at $20,000 quarterly. Variables include inventory purchases at $10 per item.

Selling 500 items yields $5,000 in variables, total cost $25,000, average $50 per item. Increasing to 1,000 items: variables $10,000, total $30,000, average $30.

Challenges arise with storage fees if inventory piles up, potentially inflating fixed costs. You can mitigate by forecasting demand accurately, keeping averages low.

Technology Startup Case (Table)

| Metric | At 10,000 Users | At 50,000 Users |

|---|---|---|

| Fixed Costs | $200,000 | $200,000 |

| Variable Costs ($5/user) | $50,000 | $250,000 |

| Total Costs | $250,000 | $450,000 |

| Average Cost per User | $25.00 | $9.00 |

A Few Things to Consider

- Misinterpreting Fixed and Variable Divisions – Often, categorizing costs incorrectly skews calculations. For example, treating utilities as fixed when they vary with usage leads to inaccurate averages. You can avoid this by reviewing expenses periodically, ensuring classifications align with actual behaviors.

- Ignoring External Factors – Economic shifts, like inflation, alter cost structures. Neglecting these can render averages outdated. You must incorporate forecasts, adjusting formulas to reflect current realities.

- Overlooking Long-Term Trends – Focusing solely on short-term figures misses broader patterns. As production evolves, averages might trend upward due to aging equipment. You can counteract by planning maintenance, preserving efficiency.

- Failing to Compare with Marginal Costs – AC alone doesn’t suffice for all decisions. Not only should you calculate it, but also compare it with the marginal to determine optimal output levels. This intersection often signals the most profitable point.

Practical Tips

- Integrating into Budgeting Processes – Start by collecting detailed cost data. You can use spreadsheets to track fixed and variable elements, computing averages regularly. This habit reveals opportunities for savings.

- Using Software Tools for Accuracy – Leverage accounting programs that automate calculations. Inputting data once generates ongoing insights, freeing time for analysis rather than manual work.

- Training Teams on Its Importance – Educate staff on how averages influence operations. You must foster a culture where everyone understands cost implications, encouraging efficiency at all levels.

- Reviewing Periodically for Improvements – Schedule quarterly reviews. Comparing actual averages against projections highlights variances, guiding corrective actions.

- Adapting to Industry Specifics – Tailor approaches to your sector. In manufacturing, emphasize volume; in services, focus on quality. You can benchmark peers, refining strategies accordingly.

FAQs

What Are Fixed and Variable Costs?

FC costs stay constant, such as rent or salaries. VC costs change with output, such as materials or fuel.

Why does Average Cost matter?

It helps you price things right, so you don’t lose customers or money. It’s like a map showing how efficiently your business uses its resources to make a profit.

Does Average Cost Change?

Yes, the average cost can shift as things like material prices rise or you make more items. It’s not fixed—keep an eye on it to stay ahead of surprises like supply hiccups or bigger batches lowering costs.

Average Cost vs. Marginal Cost?

Average cost is how much it costs to make each item, dividing total costs by the number of items. On the other side, MC is just the cost of making one extra item, like the wood and time for one more chair in a workshop.

How Does It Apply Across Industries?

Average cost works differently but powerfully in every industry. In manufacturing, it tracks how much each gadget costs to make, helping factories save money by producing more. For services, like a hair salon, it sets fair prices for haircuts by covering rent and supplies.

In retail, think clothing stores, it guides how much to charge for each shirt by factoring in storage and stock costs. Each industry tweaks it to fit its needs.

How Can Small Businesses Use AC?

Average cost helps small businesses to set the price of products smartly. E.g., A local coffee shop tracks beans, cups, and rent to figure out the cost per latte. It highlights overspending, like using too much milk.

Are There Tools for Calculations?

Yes, a host of tools make calculating the average cost easier. Spreadsheets like Excel are great for organizing data, while accounting software, such as QuickBooks, automates tasks and generates quick reports.

Can It Help Budget Planning?

Undoubtedly, the average cost lays the groundwork for smart budgeting. You can use it to figure out costs per product or any item, or event, ensuring funds are allocated wisely.

Wrapping it up

Grasping average cost equips you with tools for informed decisions. Whether defining it, applying formulas, or drawing from examples across industries, this metric underpins financial health.

Not only does it aid in pricing, but it also signals when to scale or streamline. By avoiding common errors and implementing practical steps, you enhance operational effectiveness.

It’s worth noting that consistent application turns this concept into a reliable ally for success.