- Understanding Cost of Capital

- The Formula for Weighted Average Cost of Capital (WACC)

- Examples

- Example with Market Changes

- Preferred Stock – A Telecom Company

- Why Cost of Capital Matters

- Components of Cost of Capital

- Applying Cost of Capital in Valuation

- FAQs

- What’s the Cost of Capital?

- Why’s Debt Cheaper Than Equity?

- How Do I Know If a Project’s Worth It?

- Does the Cost of Capital Change?

- How Can I Lower It?

- Wrapping It Up

What’s the real cost of turning a business dream into reality? It all boils down to the cost of capital—the price a company pays to fund its ambitions through loans or investor cash.

This isn’t just a number; it’s the key to deciding which projects soar and which fizzle.

You should learn this metric to unlock smarter choices, so you don’t have to pour money into a black hole.

In this article, I’ll unpack the cost of capital, break down its formula, and share practical examples to help you see its power in action

Understanding Cost of Capital

Cost of capital represents the minimum return a company needs to generate on its investments to satisfy its investors and lenders.

Think about funding a business expansion. You must weigh the expectations of shareholders against the interest demands of banks, because failing to meet these could erode value over time.

This metric serves as a benchmark for investment decisions, guiding whether to pursue a project or not. For instance, if a project’s expected return falls below this threshold, proceeding might destroy shareholder wealth rather than build it.

Businesses calculate it to reflect the blended cost from all financing sources, ensuring alignment with long-term goals.

As companies grow, their financing mix evolves, incorporating more debt or issuing new shares. You can view this as a dynamic figure, shifting with market conditions and internal strategies.

Keeping it low while maintaining growth potential requires careful planning, such as negotiating better loan terms or optimizing capital structure.

The Formula for Weighted Average Cost of Capital (WACC)

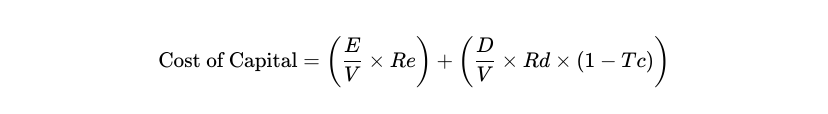

WACC combines the costs of debt and equity, weighted by their proportions in the capital structure. The standard formula reads: WACC = (E/V × Re) + (D/V × Rd × (1 – Tc)), where E is equity value, D is debt value, V is total value (E + D), Re is cost of equity, Rd is cost of debt, and Tc is tax rate.

This weighted approach ensures accuracy, as it accounts for the relative use of each funding source. Firms with heavy debt loads see lower WACC due to tax benefits, but excessive borrowing introduces financial risk.

Adjusting for preferred stock or other instruments expands the formula: WACC = (E/V × Re) + (D/V × Rd × (1 – Tc)) + (P/V × Rp), with P as preferred stock value and Rp its cost.

You can apply this in valuation models, like discounted cash flow analysis, where WACC discounts future cash flows to present value. Precision here directly impacts the estimated company worth.

Calculating WACC Step by Step

Begin by gathering market values for equity and debt. Equity often equals shares outstanding times current price, while debt includes all interest-bearing liabilities at book or market value.

Next, determine the weights: Equity Weight = E / V, Debt Weight = D / V. These fractions sum to one, representing the capital mix.

Then, plug in the component costs, remembering the tax adjustment for debt. Multiplying and summing yields the WACC.

Regular reviews keep it relevant, especially amid interest rate shifts or stock market volatility. You must factor in these dynamics to sustain informed decision-making.

Examples

Solar Energy Company

A renewable energy company is planning to build a solar farm. It has:

- Equity: $200 million

- Debt: $100 million

- Total Capital: $300 million

The cost of equity is 10%, and the pre-tax cost of debt is 6%. With a tax rate of 25%, the after-tax cost of debt becomes 4.5% (6% × (1 – 0.25)).

We calculate the capital weights:

- Equity weight: 200 / 300 = 2/3

- Debt weight: 100 / 300 = 1/3

Now, calculate the WACC (Weighted Average Cost of Capital):

WACC = (2/3 × 10%) + (1/3 × 4.5%) = 6.67% + 1.5% = 8.17%

This means the company should only invest in projects expected to return more than 8.17%, as those will add value.

Example with Market Changes

Suppose interest rates rise, increasing the debt cost to 8% for the renewable firm. After-tax becomes 6%. Recalculating WACC: (2/3 × 10%) + (1/3 × 6%) = 6.67% + 2% = 8.67%. This slight uptick might tip marginal projects into unviable territory.

You can simulate such shifts using spreadsheets, testing sensitivity to variables like beta or tax rates. This practice enhances forecasting accuracy.

In a retail chain context, equity $150 million, debt $50 million, total $200 million. Cost of equity 9%, debt 5% pre-tax, tax 28%, after-tax 3.6%.

Weights: 3/4 equity, 1/4 debt. WACC = (3/4 × 9%) + (1/4 × 3.6%) = 6.75% + 0.9% = 7.65%. Expansion into new markets would require returns exceeding this to justify.

Preferred Stock – A Telecom Company

Let’s look at a telecom company that’s using a mix of funding sources—not just regular stock (equity) and loans (debt), but also preferred stock. That’s kind of like a middle child between the two—it’s not as risky as regular shares but not as safe as debt either.

Here’s what their funding looks like:

- Equity: $400 million

- Debt: $150 million

- Preferred stock: $50 million

- Total capital: $600 million

Now, the costs:

- Cost of equity: 11%

- Debt cost: 6% before tax → becomes 4.2% after a 30% tax break

- Preferred stock cost: 7%

Let’s figure out the weights (how much each type of funding makes up the total):

- Equity: 400 / 600 = 2/3

- Debt: 150 / 600 = 1/4

- Preferred: 50 / 600 = 1/12

Now the fun part: calculating the WACC (Weighted Average Cost of Capital). That’s the blended rate the company has to “pay” to use its investors’ money. Here’s how it breaks down:

WACC = (2/3 × 11%) + (1/4 × 4.2%) + (1/12 × 7%)

= 7.33% + 1.05% + 0.58% = 8.96%

This inclusion refines the metric for firms using hybrid financing, ensuring all investor expectations are factored in.

Why Cost of Capital Matters

Evaluating investment opportunities becomes straightforward when armed with this knowledge. You must consider not only the immediate costs but also the long-term implications on profitability.

Projects promising high returns might still falter if the financing costs eat into those gains, leading to diminished net benefits.

In strategic planning, this concept aids in capital budgeting, where decisions on acquisitions or research and development hinge on accurate assessments.

Imagine allocating funds to a tech upgrade. Without factoring in the true cost, overestimation of benefits could result, causing financial strain down the line.

Moreover, investors use it to gauge company efficiency. A lower cost often signals strong management and creditworthiness, attracting more capital at favorable rates. You can leverage this understanding to compare firms within an industry, spotting those positioned for sustainable growth.

Components of Cost of Capital

Breaking it down reveals two primary elements: cost of debt and cost of equity. Each contributes differently, with debt typically cheaper due to tax advantages, while equity demands higher returns to compensate for risk.

The cost of debt arises from borrowed funds, like loans or bonds. You calculate it by considering interest rates and tax shields, as interest payments reduce taxable income. This makes debt appealing for many firms, especially those with stable cash flows.

On the other hand, the cost of equity stems from shareholder expectations, often modeled through approaches like the dividend discount model or capital asset pricing model.

Shareholders seek returns commensurate with the risk they bear, since they stand last in line during liquidation.

Blending these forms, the weighted average provides a comprehensive view. You must account for the proportion of each in the total capital structure, ensuring the calculation mirrors the actual financing mix.

Cost of Debt Explained

To compute the cost of debt, start with the interest rate on outstanding borrowings. Adjust for taxes, because the effective cost drops when interest deductibility comes into play. The formula appears as: Cost of Debt = Interest Rate × (1 – Tax Rate).

Consider a manufacturing firm issuing bonds at 5% interest with a 30% tax rate. The after-tax cost becomes 3.5%, making borrowing more efficient than it first seems. Such adjustments prove crucial, as they influence decisions on leveraging up the balance sheet.

Fluctuations in market rates affect this component, requiring regular updates. You can monitor credit ratings and economic indicators to anticipate changes, helping maintain a competitive edge in funding costs.

Cost of Equity in Detail

Determining the cost of equity involves more estimation, given its reliance on market perceptions. One common method uses the capital asset pricing model: Cost of Equity = Risk-Free Rate + Beta × (Market Return – Risk-Free Rate).

Beta measures volatility relative to the market, while the risk-free rate often draws from government bond yields. For a tech company with a beta of 1.2, assuming a 3% risk-free rate and 8% market return, the cost equates to 9%. This reflects the premium demanded for bearing additional uncertainty.

Alternative approaches include the dividend growth model: Cost of Equity = (Dividends per Share / Current Share Price) + Growth Rate. Stable firms with consistent payouts favor this, providing a direct link to shareholder returns.

You must select the method fitting the company’s profile, whether growth-oriented or mature, to avoid skewing the overall cost calculation.

Applying Cost of Capital in Valuation

In discounted cash flow models, WACC discounts projections, yielding enterprise value. Subtracting debt gives equity value, informing stock pricing.

For merger evaluations, comparing WACCs assesses synergy potential. Lower combined costs signal value creation.

You can extend this to project appraisal, where internal rate of return comparisons against WACC guide approvals.

Economic value added metrics subtract WACC from return on invested capital, measuring true profit.

Broader Implications for Investors

Individual investors benefit by using the company’s WACC in portfolio decisions. Firms with costs below industry averages often outperform.

Understanding this aids in bond versus stock choices, balancing risk and return.

As markets evolve, tracking WACC trends reveals economic health indicators.

In summary, mastering cost of capital equips for informed financial navigation, blending theory with practice for optimal outcomes.

FAQs

What’s the Cost of Capital?

It’s the return a business needs to keep its lenders and investors happy, combining the costs of debt (like loans) and equity (shareholder funds) into the WACC. Think of it as the hurdle your projects need to clear to create value.

Why’s Debt Cheaper Than Equity?

Debt’s interest payments are tax-deductible, lowering the real cost. A 6% loan with a 30% tax rate effectively costs 4.2%. Equity’s pricier because shareholders take bigger risks and want bigger returns. Ever wonder why companies love borrowing? That tax break’s a big draw.

How Do I Know If a Project’s Worth It?

If a project’s return beats the WACC, it’s likely a winner. Say your WACC is 8% and a new venture promises 12%—go for it. Below 8%? Rethink it. That’s how you avoid money pits.

Does the Cost of Capital Change?

Yup, all the time. Rising interest rates, like the 1.5% bond yield jump in 2023, push debt costs up. Stock market swings or a better credit rating can shift things, too. Keep recalculating to stay sharp.

How Can I Lower It?

Mix debt and equity smartly to use tax benefits without overborrowing. Boost your efficiency or your credit score for cheaper loans. A telecom firm in 2020 cut its WACC by 2%, saving millions. What could you do with that kind of edge?

Wrapping It Up

The cost of capital is like a financial GPS, guiding businesses through big decisions—whether it’s launching a new product or buying out a competitor.

It’s the price you pay for the money you borrow or raise, blending debt and equity into one clear number: the weighted average cost of capital (WACC).

From a solar company investing in a wind farm to a retailer opening new stores, this metric reveals which projects will drive value and which might fail.

Years in corporate finance have shown one thing: get this wrong, and you could sink cash into a losing venture. Nail it, and you’re setting up for long-term wins.

So, next time you’re sizing up a business move or stock pick, ask: What’s the cost of capital saying? It’s your shortcut to smarter choices.