- What is Purchasing Power Parity

- Formula

- Example

- How To Calculate PPP (Step-by-Step)

- How PPP Differs from Market Exchange Rates

- Why PPP is Important

- Traveling Smarter with PPP Knowledge

- Comparing Salaries Across Borders

- Investing with PPP in Mind

- Limitations

- Non-Tradable Goods Challenge Accuracy

- Short-Term vs. Long-Term Relevance

- Data Collection Hurdles

- PPP in Global Economics

- Ranking Countries Fairly

- Aid and Policy Decisions

- Trade Negotiations and PPP

- Historical Evolution of PPP

- Early Concepts in Economics

- Post-War Applications

- Modern Refinements

- Practical Tools for Using PPP

- Online Calculators and Apps

- Government and NGO Reports

- Custom Spreadsheets

If you’ve ever been to India, have you ever wondered why a Big Mac costs $5 in New York but only $2 in Mumbai, even after converting the rupees to dollars?

That single burger holds the key to a game-changing idea called Purchasing Power Parity—or PPP for short

Stay glued to the end of this article, as you’ll find out hidden truths in global salary offers, travel budgets, and even World Bank rankings that most people completely miss.

Ready to unlock the real value of money worldwide? Let’s dive in.

What is Purchasing Power Parity

Purchasing Power Parity compares the value of currencies across countries by focusing on what a single unit of money can actually buy.

Suppose you’re holding a dollar in one country and a euro in another—PPP steps in and asks whether those two amounts can pick up the exact same basket of goods, whether it’s food, clothing, or anything else you might need.

By doing so, this method really levels the playing field, because just looking at exchange rates on their own can often throw you off and mislead you, especially since those rates keep going up and down due to fluctuating market forces.

You can think of Purchasing Power Parity as a fairness meter for money, helping to make sure things are compared on an even keel.

Without it, if you just go ahead and declare one country richer than another based purely on currency conversion, you’re completely overlooking the local prices that people actually deal with day to day.

But when you adjust for PPP, it gives you a much clearer picture overall, especially because costs can swing wildly and vary so much even within the borders of the same nation.

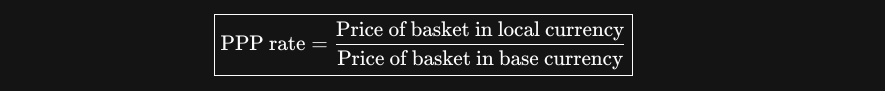

Formula

- Select a base country and a target country. Here, we take the U.S.A. and India.

- Choose a basket of comparable items — for example, a Big Mac, a liter of milk, a movie ticket, etc.

- Now, find the price of that basket in both countries:

- Let PIndia = total cost of the basket in Indian rupees

- Let PUS = total cost of the same basket in US dollars

- Apply the PPP exchange rate formula

Example

Suppose you had a haircut at a salon in Tokyo for ¥3,000 and had another haircut on the same day in a Mexican city, which cost you MXN$250

Your reaction could be why “haircuts in Mexico are quite affordable”, and on the surface, it might feel like a win.

But before you jump to the conclusion, let’s use Purchasing Power Parity to unravel what’s really happening with your money’s purchasing power in each country.

How To Calculate PPP (Step-by-Step)

- Choose the basket: Our basket has one identical haircut with the same style, same quality, and same experience in both places.

- local prices: Your haircut prices of both countries, our prices are ¥3,000 and MXN$250

- Choose a base country: Let’s pick Mexico as the base, and calculate the PPP rate in yen per peso.

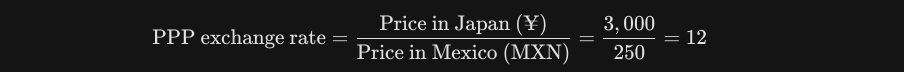

- Plug into the PPP formula: PPP exchange rate=Price in Japan (¥)/Price in Mexico (MXN)=3,000/250=12 (Yield)

Explaination

According to PPP, 1 Mexican peso buys the same haircut as 12 Japanese yen. So:

- ¥3,000 in Tokyo = MXN$250 in Mexico City → equal real value.

Now, compare that to the market exchange rate (let’s use ~7.5 yen = 1 peso for illustration):

See the difference?

- At the market rate, the Mexico haircut seems 37% cheaper (¥1,875 vs ¥3,000).

- At the PPP rate, both cost the same in real terms.

How PPP Differs from Market Exchange Rates

Market exchange rates shift daily, pushed and pulled by things like trade, investment, and even pure speculation. PPP, on the other hand, tends to stay much more stable because it roots itself firmly in the actual cost of living that people face.

For instance, a haircut that costs you $20 in a bustling U.S. city—well, that same trim might only run you about $5 in an Asian metropolis, and this kind of difference really drives home why raw exchange rates on their own simply fall short and fail to capture the true economic strength of a place.

You really have to keep this distinction in mind whenever you’re reading global reports, because it can make all the difference in how you understand the bigger picture.

Organizations like the World Bank, for example, lean on PPP to rank countries in a way that’s truly accurate and fair, steering clear of any distortions from volatile currencies.

If you rely only on market rates, though, you end up with an incomplete portrait that doesn’t tell the full story—much like judging a book’s real value just by glancing at its cover price alone.

Why PPP is Important

Traveling Smarter with PPP Knowledge

Planning a trip abroad involves budgeting, and PPP helps estimate real costs. A hotel room quoted at 100 units of foreign currency seems pricey until PPP reveals it equals far less in home terms due to lower local prices. Understanding this prevents overspending or undersaving.

You can use online PPP calculators before packing bags, ensuring funds stretch further in affordable destinations.

This knowledge turns potential surprises into calculated choices, enhancing the overall experience.

Comparing Salaries Across Borders

When job offers roll in from international companies, they typically list salaries in local currencies, which can make comparisons a bit tricky at first glance.

That’s where PPP comes into play—it smoothly converts those figures into equivalent purchasing power, clarifying if the pay supports a similar lifestyle.

For example, earning 50,000 in a high-cost area might lag behind 30,000 in a cheaper region after adjustments.

You must factor in PPP whenever you’re negotiating relocations, because those nominal amounts can really deceive you if you don’t put them into the right context first.

By taking this step, you end up securing fair compensation that truly lines up with what you expect, and it helps bridge the gap between the numbers on paper and the reality you’ll face on the ground.

Investing with PPP in Mind

Global investors watch PPP to spot opportunities. Currencies trading below PPP levels may appreciate over time as markets correct imbalances.

Spotting these gaps requires tracking price differences in goods and services.

You can monitor PPP-based indices to guide portfolio decisions, balancing risks across borders. This strategy informs long-term planning, capitalizing on economic alignments.

Limitations

Non-Tradable Goods Challenge Accuracy

Services like rent or haircuts don’t cross borders easily, yet they dominate spending in many places. PPP struggles here because local factors dominate pricing without global competition.

You must view PPP as an estimate, not an absolute truth, especially in service-heavy economies. This awareness tempers overreliance.

Short-Term vs. Long-Term Relevance

PPP shines in long-run analyses, predicting currency adjustments over years. Daily fluctuations, however, follow market dynamics unrelated to goods prices.

You can use PPP for strategic planning while checking market rates for immediate transactions, blending both wisely.

Data Collection Hurdles

Collecting accurate and up-to-date price data for thousands of items across different countries proves resource-intensive because it takes a tremendous amount of effort to get everything right.

Besides, the surveys often miss out on informal markets or regional variations that exist within a single country, and this oversight ends up introducing errors.

You have to cross-reference multiple sources for robust insights, as this helps you build a fuller understanding, despite imperfections.

PPP in Global Economics

Ranking Countries Fairly

GDP per capita in PPP terms reveals true living standards, elevating nations with low costs despite modest nominal outputs. China and India rise in such rankings, reflecting the vast populations’ buying power.

You can explore the World Bank data to see these shifts, and along the way, you’ll come to appreciate how PPP truly democratizes economic comparisons.

Aid and Policy Decisions

Governments and NGOs allocate resources using PPP to ensure aid buys equivalent help everywhere. This equity prevents wasteful disparities.

You must support PPP-informed policies because they promote balanced global development.

Trade Negotiations and PPP

Negotiators reference PPP to argue fair terms, countering claims of unfair advantages from currency values. This grounding fosters mutually beneficial agreements.

You can follow international talks to observe PPP’s role, deepening engagement with world affairs.

Historical Evolution of PPP

Early Concepts in Economics

Scholars in the 16th century noticed price disparities driving trade, laying PPP foundations. Formal theory emerged in the 20th century amid post-war reconstructions.

You can trace this history to value modern applications and connect past insights to present tools.

Post-War Applications

Bretton Woods institutions adopted PPP for stability, influencing currency pegs and adjustments. This era solidified its analytical status.

You must study these milestones for context and try to enrich your comprehension of current uses.

Modern Refinements

Advanced computing enables detailed baskets with thousands of items, boosting accuracy. Ongoing tweaks address globalization’s impacts.

You can stay updated on evolutions, adapting knowledge as methods improve.

Practical Tools for Using PPP

Online Calculators and Apps

Websites offer instant PPP conversions, inputting amounts and countries for adjusted values. These simplify planning.

You can bookmark reliable tools or integrate them into routine decisions.

Government and NGO Reports

Annual publications detail PPP-adjusted metrics, providing authoritative data. Accessing these builds informed perspectives.

You must consult official sources regularly, as this ensures accuracy over anecdotes.

Custom Spreadsheets

Building personal models with price data allows tailored analyses. Formulas automate calculations for ongoing use.

You can play around with spreadsheets and, in the process, pick up hands-on mastery.