- What ROI Really Means

- The Formula

- How To Calculate ROI (Step-by-Step)

- Examples

- Example 1: Sneaker Reselling

- Example 2: Gaming PC Upgrade

- Example 3: Online Course for Freelance Skills

- Example 4 – CNC Machine (Advanced)

- A Few Things To Consider

- Tools

- When ROI Isn’t Enough

- Advanced Tips for Sharper Decisions

- Frequently Asked Questions

- Wrapping Up

You must have invested money in the stock market at some point, right? So, how much return have you pulled out so far? Exactly—this is what we call Return on Investment, or ROI.

Any profit you make beyond the initial amount you put in? That’s your ROI. But is it really that straightforward?

It’s like a report card that businesses, high-net-worth individuals (HNIs), or individuals like us rely on to gauge how well any company or venture is growing, or even to track the progress of their own investments over time

Calculating it helps decide whether an action pays off or drains the wallet.

In this article, not only will I break everything down in a straightforward way, but also provide helpful tips and engaging examples that’ll help you calculate Return On Investment like a pro. Let’s jump right in.

What ROI Really Means

It shows the percentage gain or loss on an investment. Positive numbers mean profit. Negative ones signal loss. Simple, right? Yet understanding the “why” matters more than the “what.”

Why It Exists

People invest time, cash, or effort expecting returns. ROI quantifies that expectation. Skipping it leads to blind decisions. Ever bought a game skin pack that never got used? That’s negative ROI in action.

Everyday Relevance

You face ROI daily without noticing. Choosing between two part-time jobs? Compare hourly pay against commute costs. Deciding on a new phone? Weigh price against features and resale value. Return on Investment turns gut feelings into numbers.

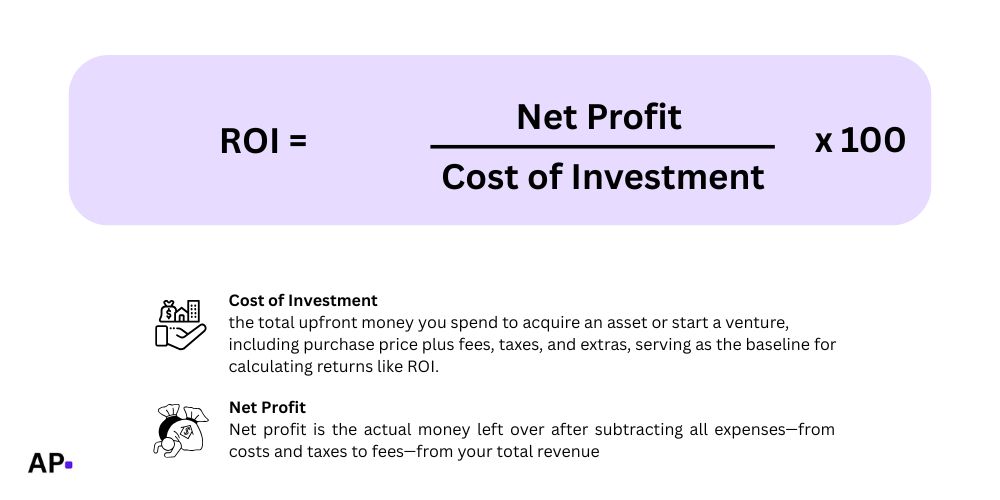

The Formula

The standard formula looks like this:

ROI = (Net Profit / Cost of Investment) × 100

Net Profit equals total returns minus the initial cost. Multiply by 100 to convert to a percentage. That’s it—no fancy calculators required.

How To Calculate ROI (Step-by-Step)

- Identify the cost. Include everything spent: purchase price, shipping, setup fees.

- Calculate returns. Add all gains: sales revenue, resale value, and savings.

- Find net profit. Subtract cost from returns.

- Divide and multiply. Follow the formula exactly.

Annualized ROI for Longer Periods

Short investments use the basic formula. Longer ones need adjustment because time changes value. Use this version:

Annualized ROI = [(1 + ROI)^(1/n) – 1] × 100

Here, n represents years. This levels the playing field when comparing investments of different lengths.

Examples

By now, you’ve probably understood what it is and how to calculate it. But what’s the point if you haven’t actually put it into practice?. So let’s break it down with a few examples to make it click.

Example 1: Sneaker Reselling

A 16-year-old purchases limited-edition sneakers for $150, including shipping. Six months later, resale fetches $250. Since six months isn’t a full year, annualize when comparing to stocks:

| Factor | Value |

|---|---|

| Cost | $150 |

| Returns | $250 |

| Net Profit | $250 − $150 = $100 |

| Return on Investment | ($100 ÷ $150) × 100 = 66.67% |

| Annualized Return on Investment | [(1 + 0.6667)^(1 ÷ 0.5) − 1] × 100 ≈ 50.4% |

| Summary | Solid flip, considering the effort involved. |

Example 2: Gaming PC Upgrade

Upgrading a graphics card costs $400. Better performance allows streaming on Twitch, earning $120 in donations over three months.

- Cost: $400

- Returns: $120

- Net Profit: $120 – $400 = -$280

- ROI: (-$280 / $400) × 100 = -70%

Loss shows. Streaming needs more time or a bigger audience before turning positive.

Example 3: Online Course for Freelance Skills

An online coding course costs $200. Completing it lands freelance gigs paying $800 in the first year.

| Factor | Value |

|---|---|

| Cost | $200 |

| Returns | $800 |

| Net Profit | $800 − $200 = $600 |

| Return on Investment | ($600 ÷ $200) × 100 = 300% |

High return justifies the upfront spend, especially since skills keep paying.

Example 4 – CNC Machine (Advanced)

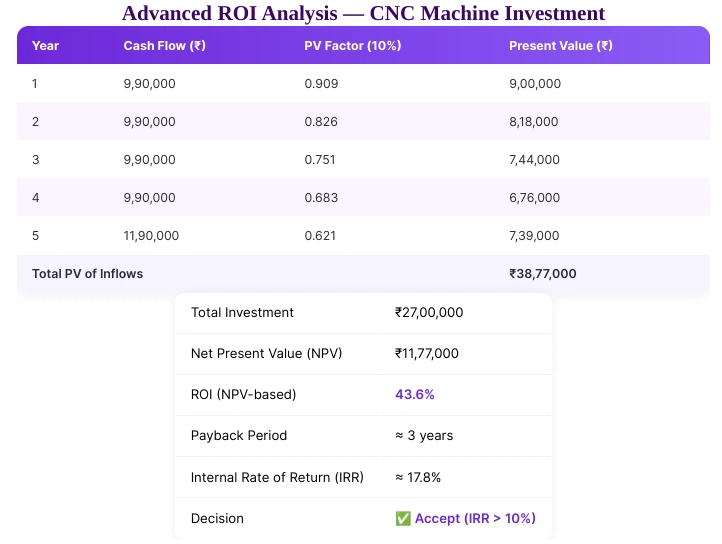

The above picture shows how investing in the CNC machine can be profitable with an initial investment of ₹27 lakh.

Even though it costs around $30,490 in US currency, it still helps the company earn extra income and save costs every year.

As it shows, in the span of five years, it racked up (after taxes and time value) around ₹38.77 lakh or $43,782.

That means a profit of ₹11.77 lakh ($13,212) in today’s money, giving an ROI of 43.6% and an IRR of around 17.8%.

In short, the machine pays more than its investment in just three years, beating the company’s minimum return target, so it’s a good decision to purchase the machine.

A Few Things To Consider

Forgetting Hidden Costs

Shipping, taxes, or time count. Ignoring them inflates ROI. Always list every expense before calculating.

Mixing Time Frames

Comparing a one-month flip to a two-year stock hold distorts reality. Annualize when periods differ, as shown earlier.

Confusing Gross and Net

Gross returns ignore costs. Net profit does not. Stick to the net for honest pictures.

Overlooking Intangible Benefits

Brand exposure or learning new skills adds value hard to quantify. Note these separately rather than forcing them into the formula.

Tools

Spreadsheets

Google Sheets or Excel handles formulas automatically. Input cost in cell A1, returns in A2, then use =(A2-A1)/A1*100 in A3. Copy for multiple investments.

Mobile Apps

Apps like Investment Calculator or ROI Calc offer templates. Just punch in numbers, get instant results, and visualize trends.

Manual Method

Paper works fine for quick checks. Write cost, subtract from returns, divide, multiply by 100. Keep practicing to build speed.

When ROI Isn’t Enough

Risk Factor

High ROI often means high risk. A 500% return from crypto can vanish overnight. So balance with stability checks.

Opportunity Cost

Money tied in one place can’t fund another. So compare ROI across options before committing.

Non-Financial Goals

Sometimes investments serve learning or fun. A negative ROI concert ticket still delivers memories. You must decide what matters most.

Advanced Tips for Sharper Decisions

Scenario Testing

Run best-case, worst-case, and realistic projections. Adjust variables like sales price or time to see impacts.

Break-Even Analysis

Find the minimum return needed for 0% ROI. Divide the cost by expected units or time. Guides pricing or effort.

Portfolio ROI

Average multiple investments. Weight by cost: (Investment A ROI × Cost A + Investment B ROI × Cost B) / Total Cost.

Frequently Asked Questions

A negative ROI lays bare the downside loud and clear—it straight-up signals that your initial investment has outpaced any returns, putting you squarely in the red with a net loss. This could be due to hefty taxes or a sharp drop in share prices. That said, you only invest after evaluating all the essential factors of a company or stock.

Yes, you can assign actual dollar values to those non-financial inputs, so everything lines up nicely.

For projects that keep going, like your side hustle, check your ROI every month so you can spot money problems early and fix them fast. For projects that take longer, like a year-long app build, aim for every three months to keep tabs on how it’s holding up overall.

It’s not crucial for your ROI to always be sky-high. Sure, a high ROI signals solid profits, but if it got in such a short span, it can be pretty risky too. Take crypto, for instance—if you throw money in and it doubles in just 10 days, you’ve got a 100% ROI. All the same, it’s smarter to play it safe and keep things steady.

Yes, you can use the formula for team or group investments. Suppose you and your friend split a $300 movie ticket and resell it for $500, you’ll make a whopping $200 net profit, making an ROI of 66.67%. Once you’ve made a profit, you can divide half the profit with your friend, based on contribution ratios.

Wrapping Up

Calculating ROI really starts to build your confidence over time, since it eliminates assumptions for hard numbers that you can actually trust and act on.

Whether you’re thinking about reselling some old clothes online or saving up steadily for college, this tactic ensures your choices stay sharp and your wallet ends up a whole lot happier in the long run.

So, before we wrap up, make sure you practice it regularly to streamline your money growth.