What if you discovered that two companies can bring in the exact same $1 million in sales, yet one pockets $250,000 while the other limps away with just $40,000? That gap isn’t luck—it’s the quiet power of net profit margin at work.

Earning a solid 25.9% margin in 2024, Apple turned every sales dollar into roughly a quarter of pure profit after paying all bills.

Meanwhile, at just 3.8% that same year, a major airline barely covered fuel and crew by squeezing pennies from each ticket. This result shows the same economy but different outcomes.

You see the pattern everywhere. Spotify streams billions of songs yet fights to stay above 2% margins. A small indie game studio releases a hit title and suddenly enjoys 35%.

Why do some businesses turn sales into real money while others bleed cash on every transaction?

The answer hides in a single percentage that strips away the noise of revenue hype and reveals true efficiency. Curious yet?

In this article, I’ll walk you through the formula and examples that’ll help you streamline your business. Ready to barge forward? Let’s dive straight into the article.

What Is Net Profit Margin?

It measures a company’s net profit over time as a percentage after paying off all the expenses. You can think of it as the percentage of sales that turns into actual earnings.

It shows efficiency or how a business runs. That said, if a margin is high, it means the business controls costs well, while a low one signals room for improvement.

For instance, giant companies like Apple or Tesla launch different products based on the latest technology so they don’t fall behind.

Hence, they aim for higher margins by innovating products that don’t cost much to produce once developed.

Businesses use this metric to keep an eye on their competitors to see growth. You’ll understand it better with examples, but first let’s know its formula.

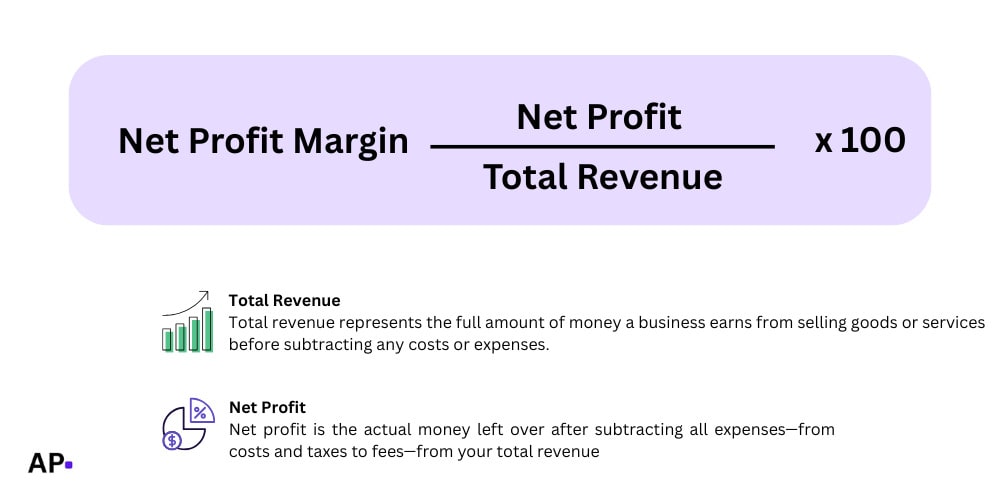

The Formula for Net Profit Margin

Unless you’re a math geek, you can’t yield its percentage without understanding its formula. To know the Net Profit Margin, all you’ve to do is take net profit and divide it by total revenue, then multiply by 100. That’s it, once you follow all the steps, you’ll get your Net Profit Margin

Net Profit Margin = (Net Profit / Total Revenue) × 100

Net Profit is nothing but your total earnings that you’ve gained after all expenses, taxes, and interest from revenue. Meaning, it’s your take-home funds that you can use to buy things for yourself, reinvest in a company, or do whatever you want to do.

Revenue, on the other hand, is the total money you get from sales before reimbursing taxes or covering all expenses. So the revenue comes first, and then after deduction, it becomes your Net profit.

You don’t have to jot down your transactions or overall revenue manually, as you can take the help of any good software or hire an accountant to get the job done for you.

Anyway, but why multiply by 100? It turns a decimal into a clear, everyday percentage—making it instantly understandable and easy to compare – Because 15% is easier to remember than a decimal like 0.15.

How to Calculate Net Profit Margin (Step by Step)

- Collect Data: Pull the income statement or financial records. Identify total revenue at the top— that’s all the money earned from core activities.

- Find Net Profit: Next, find the net profit at the bottom. You won’t have to subtract expenses or other operating costs, as this is already a net profit.

- Divide: Once you’ve all the financial data in place, divide both metrics. Let’s assume $50,000 as revenue and $200,000 as net profit. If we calculate, it yields 0.25.

- Multiply: 0.25 is just a decimal. Now multiply it by 100. It will give 25, which will be NPM.

You’ve to include everything in revenue, such as expenses, operating costs like salaries, rent, and other utilities.

For seasonal businesses, calculate over a full year to avoid skewed results from busy periods. Averaging multiple periods smooths things out.

Tools like spreadsheets may help. Simply enter formulas in cells for automatic updates when numbers change. This way, you can track improvements without having to manually recalculate.

What if revenue is zero? The margin becomes undefined or negative, indicating losses. Negative margins happen, especially for startups investing heavily upfront.

Practice with public company data. Many firms publish reports online, letting you plug in numbers and see real outcomes.

Examples

Consider a software startup that develops apps, has earned $1 million in revenue or sales from downloads and subscriptions.

If it subtracts its developers’ salaries, taxes, and other operating expenses, it is left with $700,00, and $300,00 in net profit.

So to get the Net profit margin, we’ve to plug these into the formula:

That is $300,000/$1,000,000 *100 = 30%. From the business growth perspective, it’s a solid margin.

Now let’s take another example of a retail chain that sells sports gear. It racked up $2 million in sales of jerseys and equipment.

However, after deducting all the staff wages and operating costs or expenses, it paid off $1.6 million. It has saved up $400,000.

Now it has a 20% Margin, which is quite good, as it reflects good cost control and smart inventory management.

In the picture below, you can see the NMP across different industries and try to calculate it yourself.

Factors Affecting Net Profit Margin

Costs Rise

It decreases sales, and consequently, the margin drops too.

Pricing:

If you raise your price from $10 to $12 per item, you keep more per sale. In contrast, if you drop it to $8 to beat a rival, you’ll keep less.

Efficiency:

When using smarter tools, you waste less and gain a stronger margin.

Taxes:

No doubt, higher taxes impact profit, resulting in a lower margin.

Competition:

In crowded markets or where competition is cutting-edge, you sell at low prices and get thin margins.

Economy dips:

It’s an unpredictable factor that can adversely affect NPM, as it can increase rent, drop sales, affect salaries, and more.

Innovation:

Unique or cheaper products can get premium pricing and a high margin.

How To Improve Net Profit Margin

Grow revenue, control costs

If you want better margins? You must focus on revenue growth and cost control.

Increase sales channels

You should also focus on increasing sales through marketing or expanding offerings. For example, adding online sales to a physical store can broaden reach without huge costs.

Cut expenses

Consider cutting unnecessary expenses by negotiating with suppliers for discounts or switching to cheaper alternatives without compromising quality.

Boost Productivity

When it comes to productivity, hire training staff or automate tasks to reduce labor hours needed per sale.

Diversify income

The most crucial thing you can do is diversify income, as relying on one product can risk margins if demand falls; also, multiple streams provide stability.

Monitor Pricing

You can adjust pricing based on costs and market— not too high to scare customers, not too low to undervalue.

Outsource Work

Outsource non-core activities. If you handle everything in-house, you might lose more money than when you hire specialists.

Track Progress

Track metrics over time. Keeping tabs on your progress is essential. You must set goals and measure progress accordingly.

It’s worth noting that improvements can take time. You should always opt for sustainable goals over Quick fixes to build a stronger business.

Net Profit Margin vs. Other Profit Margins

Other metrics sound similar, but Net differs from gross and operating margins.

Gross profit margin: (Revenue – Cost of Goods Sold) / Revenue × 100. It focuses on production efficiency.

Operating adds operating expenses to the mix, showing core business profitability before interest and taxes.

And Net goes furthest, including everything. Use all three for a full picture.

For example, if you’ve a high gross but low net? You can blame overhead or taxes.

So you’ve to choose the right one based on what you analyze.

Limitations

- Ignores assets used.

- One-offs distort it.

- Misses cash flow.

- Industry-blind comparison.

- Past-only snapshot.

- Needs other metrics.

Summing Up

Understanding net profit margin equips you to evaluate businesses smarter. Whether checking a favorite company’s reports or planning your own venture, this metric offers insights.

You can start small: pick a public firm, grab its income statement, and crunch the numbers. See how margins changed over the years and why.

As we know, practice builds confidence. When you interpret financials, it will become your second nature.

Remember, it’s all about how efficient and sustainable your business is, and high margins show your business’s resilience.