- The Basics of Cash Flow

- Why Cash Flow is Important

- The Cash Flow Formula

- Examples

- The Part-Time Barista

- The Online T-Shirt Seller

- The Freelance Artist

- How to Keep Your Cash Flow in Check

- Make a Cash Flow Plan

- Keep an Eye on It

- Save Some Cash for a Rainy Day

- Cash Flow Traps

- Thinking You’ll Get Paid Right Away

- Forgetting Small Expenses

- Getting Stuck with Debt

- Cash Flow FAQs

- Wrapping It Up

Ever wonder why some people or businesses always seem short on cash, even when they’re making money? It’s not just about earning—cash flow is the real key.

It’s like the heartbeat of your wallet or a business, keeping everything running smoothly. Here’s a fact: 82% of small businesses fail because they don’t monitor their cash flow, according to U.S. Bank.

Amazed, right? Cash flow isn’t just boring numbers; it’s about knowing how to keep money moving so you can pay for things like your phone bill, a new laptop, or even a dream trip.

In this article, I’ll break down what cash flow is, why it’s a big deal, and how you can get a handle on it.

The Basics of Cash Flow

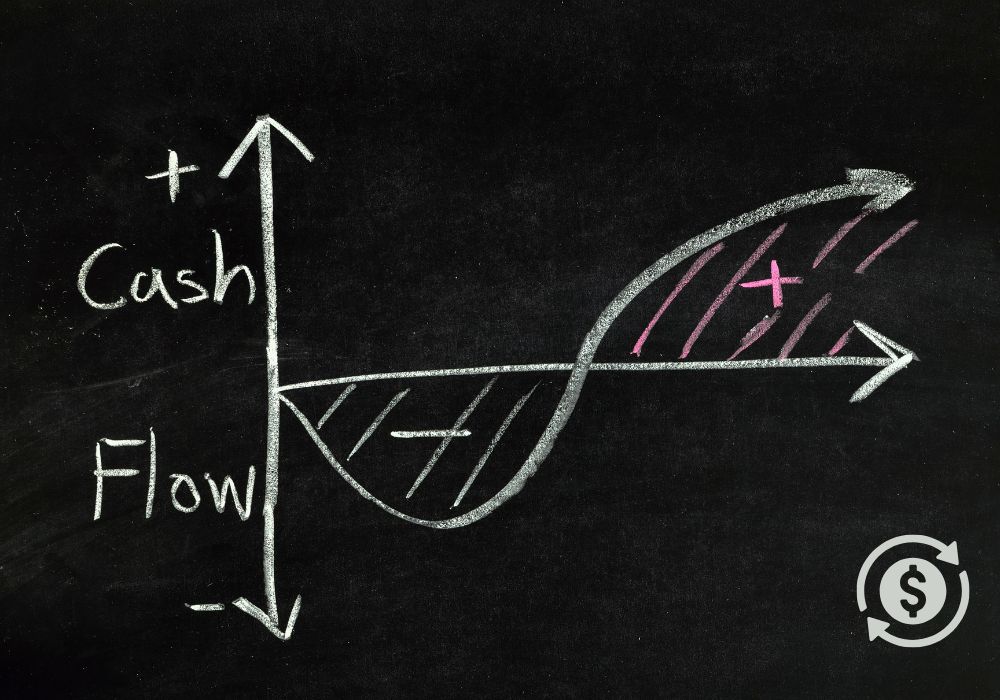

In a nutshell, Cash flow is all about the money coming in and going out of your pocket or a business over a certain time.

Visualize it like water flowing through a pipe—money flows in from things like your part-time job, birthday cash, or a business’s sales, and it flows out for things like snacks, rent, or supplies.

It’s not the same as profit, which is just a number on paper. Cash flow is the actual cash you can use right now.

Why does that matter? Let’s say you sell a cool hoodie online for $50. Sounds like a win, but if the buyer doesn’t pay for a month, you can’t use that money to buy supplies for more hoodies.

Suppose your friend once sold custom bracelets and thought they were killing it—until they realized they couldn’t pay for new beads because customers were slow to pay. That’s a cash flow problem.

You can split cash flow into three fragments: operating (buying supplies or getting paid), investing (big purchases), and financing (money from loans or paying them back).

Knowing these helps you see where your money’s coming from and where it’s disappearing to.

Why Cash Flow is Important

Cash flow tells you how healthy your finances are. If more money’s coming in than going out, you’re in a good spot—you’ve got positive cash flow.

You can save, spend, or handle surprises like a broken phone. But if more money’s going out than coming in? That’s negative cash flow, and it’s like trying to run a race with no energy left.

By keeping tabs on cash flow, you can figure out how to stock up smarter and avoid running out of cash.

You can run into the same issue—like when you blow your whole paycheck on new shoes and then can’t afford gas for the week.

You can apply cash flow for basic things like rent, food, and other things that add value to your daily life. It’s not just meant for businesses; anyone can use it. That said, cash flow is quite important to avoid stress and plan better.

The Cash Flow Formula

Calculating cash flow is straightforward. The basic formula is:

Cash Flow = Cash Inflows – Cash Outflows

- Cash Inflows: Money coming in, like wages, sales, or loan funds.

- Cash Outflows: Money going out, like bills, groceries, or debt payments.

If you’re in a business, you can calculate net cash flow by combining operating, investing, and financing cash flows:

Net Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

To keep it simple, pick a time frame like a month, total up all the cash coming in, take away all the cash going out, and that’s your cash flow.

If it has a Positive value, it means more cash came in, while a negative value means more went out. Instead of manually doing it, you can use tools like spreadsheets or any decent app to track cash flow easily.

Examples

To make this clearer, here are a few examples showing cash flow in action:

The Part-Time Barista

A 17-year-old works part-time at a café, earning $500 a month. Expenses include $200 for a phone bill, $100 for gas, and $50 for eating out. Using the formula:

- Inflows: $500 (wages)

- Outflows: $200 + $100 + $50 = $350

- Cash Flow: $500 – $350 = $150

This $150 means there’s extra cash to save or spend. But one month, a $200 car repair pops up. Outflows jump to $550, making cash flow negative ($500 – $550 = -$50). So to avoid this, cutting back on eating out or saving a little each month could help.

The Online T-Shirt Seller

A teen runs an online T-shirt shop, selling $1,000 worth of shirts in a month. Costs include $400 for materials, $100 for shipping, and $200 for ads. The catch? Only $600 of sales are paid upfront; the rest comes in 30 days.

- Inflows: $600 (cash received)

- Outflows: $400 + $100 + $200 = $700

- Cash Flow: $600 – $700 = -$100

This negative cash flow shows a cash shortage, even with great sales. To fix it, negotiating faster payments or reducing ad spending could balance things out.

The Freelance Artist

A student does freelance art, earning $800 for a project. Expenses are $150 for art supplies and $50 for software subscriptions. But the client pays in 60 days.

- Inflows: $0 (no cash yet)

- Outflows: $150 + $50 = $200

- Cash Flow: $0 – $200 = -$200

This negative cash flow forced the artist to dip into savings. Asking for a deposit upfront or spacing out projects could keep cash flowing.

How to Keep Your Cash Flow in Check

You don’t need to be a math genius to manage cash flow. It’s about staying organized and paying attention. Here’s how you can do it:

Make a Cash Flow Plan

Think of a cash flow plan like a budget, but cooler. It’s guessing how much money you’ll get and spend over a week or a month.

List your income—like your job or allowance—then subtract elements like phone bills, food, or gas. You can use a notebook, a phone app, or even a free spreadsheet.

Keep an Eye on It

Check your cash flow regularly, like you check your phone. Look at your bank account, track what you’re owed, and chase late payments.

You’ve got to stay flexible, too. If you’re spending more than you’re earning, cut back or find ways to make extra cash, like selling old clothes online. Small tweaks can make a big difference.

Save Some Cash for a Rainy Day

Having extra cash saved up is like having an umbrella when it storms. Try to save enough to cover a few months of expenses.

You can start small, even saving 5% of your money each month. It adds up. Plus, having a cushion means you can take risks, like starting a small side hustle or buying supplies for a new hobby.

Cash Flow Traps

Even smart people can have negative cash flow sometimes. Here’s what to avoid:

Thinking You’ll Get Paid Right Away

It’s easy to assume money’s coming soon, but delays happen. A teen who sold custom phone cases online may think he’d get paid instantly, but shipping delays meant cash came in late – He almost couldn’t afford new materials.

So you can avoid this by expecting some hiccups and planning for them.

Forgetting Small Expenses

Little things—like streaming subscriptions or daily coffee—can sneak up on you.

Cutting those can free up cash for bigger goals, like a new game. You should check your spending every month to spot these leaks.

Getting Stuck with Debt

Borrowing money can help, but it’s tricky. High-interest credit cards or loans can eat your cash.

You can shop around for better loan terms or pay off debt fast to keep more cash.

Cash Flow FAQs

Profit is what’s left after cutting expenses from income, but it’s just a number on paper. On the other hand, Cash flow refers to the actual movement of money in and out. You can have profit but no cash if payments are delayed, like when a customer owes you money.

You can check it weekly or monthly, depending on the amount of cash you handle. If you’ve got a side gig, weekly checks can help. Personally, monthly is usually enough.

Basically, having a ton of cash just sitting there might mean you’re not making the most of it, like investing in something that could make more money. But having more cash saved up is always a smart idea for when things go wrong.

Pick up a notebook or use an app to jot down all the money you’re spending and getting each month. Monitor what’s flowing in and what’s heading out. Even a quick list makes it super clear where your money is going.

Wrapping It Up

Cash flow isn’t just some buzzword—it’s your ticket to staying in control of your money. Sounds good?. If we sum up, it’s about knowing where your cash is, planning for surprises, and making savvy decisions.

So whether you’re saving for a new phone, starting a side hustle, or just trying to avoid being broke before payday, cash flow is something you should focus on.

If you’ve read through the whole article, you can handle cash flow like a pro, with extra cash for the things that matter most.