- What Is CRA My Account?

- Step 1: Visit the CRA Register Page

- Step 2: Choose a Sign-In Method

- Step 3: Submit Your Basic Details

- Step 4: Verify Your Identity

- Step 5: Complete the Verification Process

- Step 6: Set up multi-factor authentication (MFA)

- Step 7: Set Up Security Questions

- How To Use CRA My Account?

- Troubleshooting Common Issues

- Tips for a Smooth Experience

- Summing it Up

As we know, navigating government websites can sometimes be quite irritating and overwhelming. But there is nothing to worry about; we’ve piled up all the steps you need to access your CRA My Account.

This step-by-step guide will walk you through the process, ensuring you can access your tax information with ease. So without any further ado, let’s dive into the article.

What Is CRA My Account?

CRA My Account is an online portal that lets you manage your tax information, check benefits, and handle other CRA services.

Think of it as your personal tax hub. So why register it? It saves time, reduces paperwork, and keeps everything in one place. Convenient, right?

Step 1: Visit the CRA Register Page

Head to the Register for a CRA account at canada.ca. So once you land the page, it will ask you to sign in if you’re already registered. You can use the same sign-in method to log in that you used for registration.

And if you’re signing up for the first time, skip this step and jump to the next option.

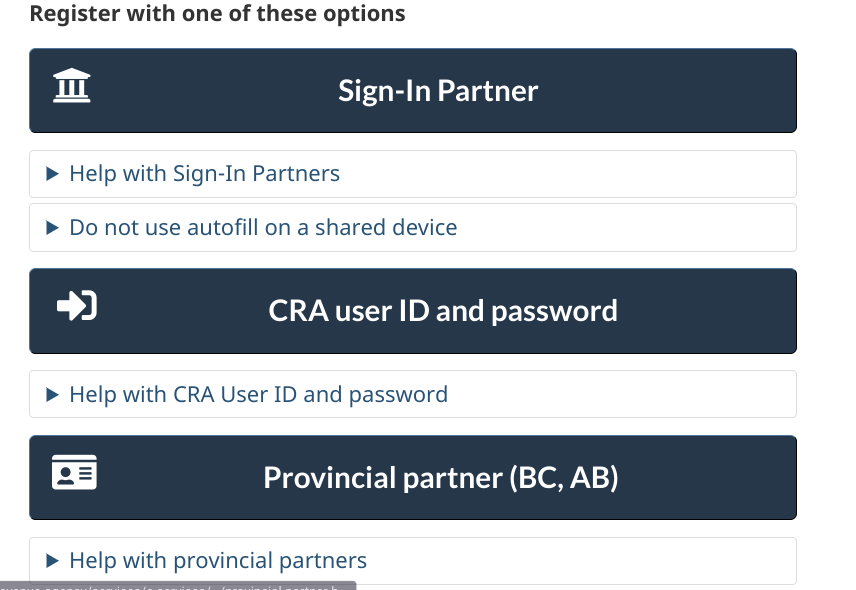

Step 2: Choose a Sign-In Method

The CRA offers three main ways to log in. You can opt for any one that suits you:

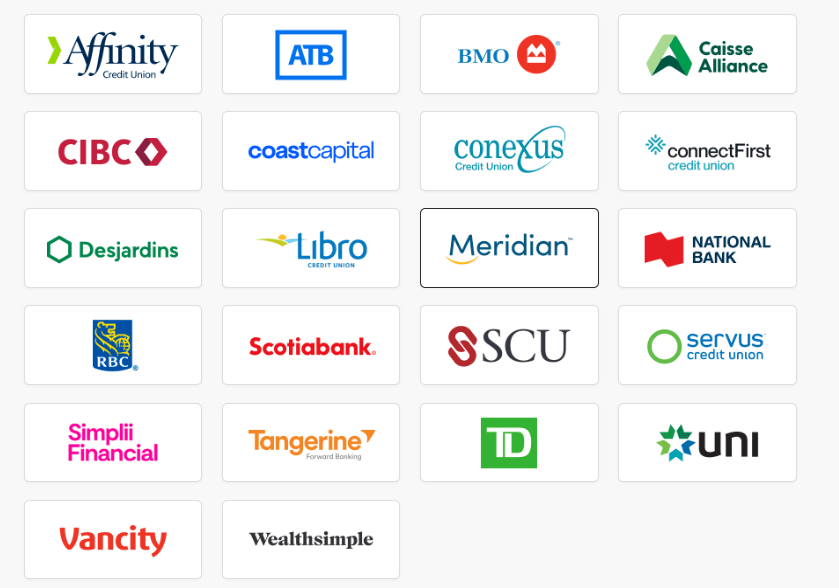

- Sign-In Partner: If you’ve a bank account in any of the banks below, you can access CRA My Account using your bank’s credentials. This is a quick option, as it doesn’t require creating a separate account.

- CRA Login: Create a CRA-specific user ID and password. You’ll need to set up a User ID, password, and security questions.

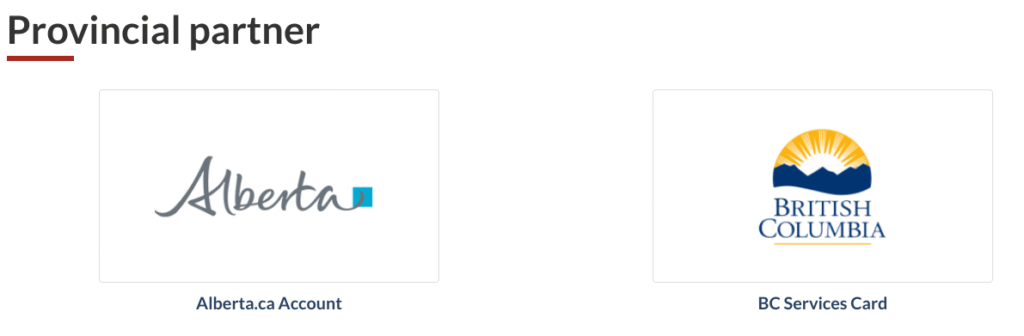

- Provincial Partner (BC, AB): If you’ve a BC services card or an Alberta.ca account, you can access the CRA My Account.

Which one’s better? It depends. Sign-In Partner is faster if you’re comfortable using your bank. However, CRA Login gives you more control. You can choose wisely.

Step 3: Submit Your Basic Details

First off, provide a few things.

- Social Insurance Number (SIN): Your nine-digit SIN is essential. It’s your unique identifier with the CRA.

- Date of Birth: Ensure you have this handy for verification.

- Recent Tax Return: The CRA may ask for details from your most recent Notice of Assessment (NOA). Specifically, you’ll need your net income from a past return.

Got everything? Great. Let’s move forward.

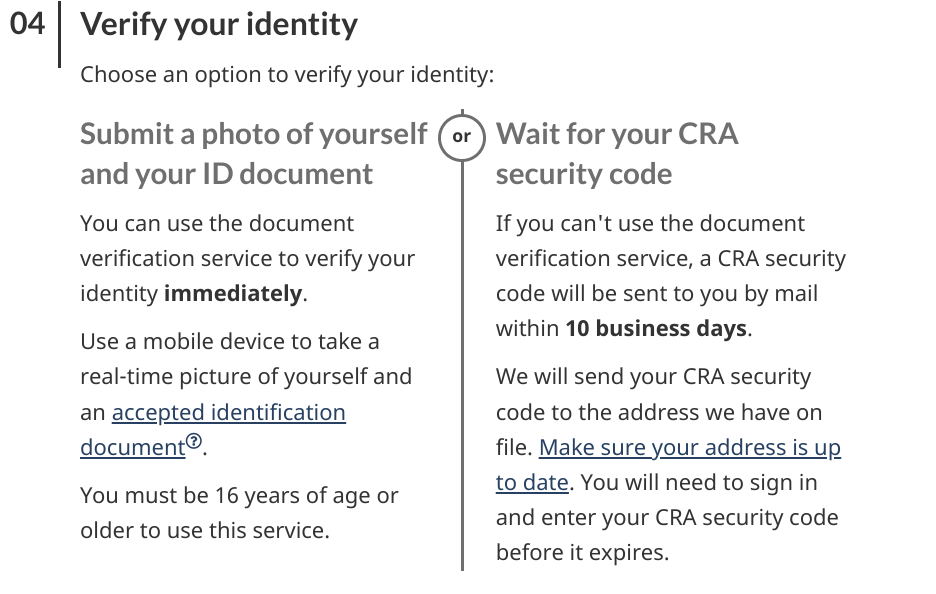

Step 4: Verify Your Identity

Now, the CRA offers the two options to verify your identity and use its services. You can either submit your documents via mobile or enter a CRA security code sent to your email or the address you’ve on your file. When choosing the CRA security code, make sure you log in before it expires.

Remember, you get limited access to “For My Account” without verification. You can view your tax return status, Pay by pre-authorized debit, and a few more things.

Note: You need a decent mobile camera and your Canadian government-issued ID for verification.

Step 5: Complete the Verification Process

Got the code? Awesome. Now log back into My Account using your chosen sign-in method. Navigate to the section prompting for the security code.

If the code doesn’t work, you can reach out to the CRA at 1-800-959-8281. They’ll figure it out.

Step 6: Set up multi-factor authentication (MFA)

When you follow through the sign-up process, you’ll be asked to create a one-time passcode to add a second layer of protection, in addition to a password.

To generate a one-time passcode, you can use any authentication app, phone, or passcode, whichever you think is fair.

Step 7: Set Up Security Questions

If you need an extra layer of protection, you can add a few security questions that only you can answer. Like, what’s your first school name or pet name?.

If you’re a Sign-In Partner user, you don’t need to go through all these processes and can directly access your CRA account.

How To Use CRA My Account?

Once you’re in! You’ll see your dashboard loaded with a slew of options to manage your account. Here’s what you can do:

- View Tax Returns: Check past returns and Notices of Assessment.

- Manage Benefits: Track Canada Child Benefit or GST/HST credits.

- Update Info: Change your address or direct deposit details.

- File Documents: Submit forms without mailing.

You can take a moment to explore, and once you’re familiar with the tools, things will become quite easier.

Troubleshooting Common Issues

Things don’t always go smoothly. Here are quick fixes for common hiccups:

- Forgot User ID or Password? You can tap “Forgot User ID” or “Reset Password” links. Answer your security questions, and you can log back in again.

- Code Not Received? You must wait for at least 10 business days. If you still receive nothing, call the CRA. They may surely resend it or verify you another way.

- Locked Out? If you’ve tried to sign in with incorrect login credentials, your account may be locked. In such a case, contact the CRA team and ask to unlock it.

Persistence is the key here. Just don’t try giving in.

Tips for a Smooth Experience

A few things to remember to keep things easy:

- Save details: Keep your User ID, password, and security questions secure. You can jot them down in your diary or use any password manager.

- Update Contact Info: Don’t use the inaccurate address and phone number to avoid any delay. Ensure your details match the CRA.

- Check Regularly: You should log in sporadically to stay updated on benefits or notices.

If you follow these points, you won’t face any trouble later.

Summing it Up

Registering for CRA My Account might seem daunting. But break it down, step by step, and it’s manageable. Submit your documents.

Choose your sign-in method. Verify your identity. Wait for the code. Then, explore. That’s it. Still stuck? The CRA’s helpline will assist. Now, go set up that account and take control of your taxes.