Imagine a small business owner, let’s call him Noah, hunched over his laptop in a dimly lit living room, surrounded by crumpled receipts and a cold cup of coffee.

He’s trying to figure out where his money’s going, but it feels like he’s solving a puzzle with half the pieces missing.

Sound like a familiar nightmare? That’s where Wave Accounting comes in, like a friendly neighbor with a flashlight and a knack for organization.

This article breaks down Wave Accounting in a simple, engaging way to keep things light.

It’s all about making bookkeeping feel less like a root canal and more like a manageable part of running a business.

What’s Wave Accounting?

Wave Accounting is a cloud-based tool designed to help small businesses, freelancers, and side hustlers keep their finances in check without needing a degree in accounting.

Assume it as a digital buddy who handles the boring stuff—tracking expenses, sending invoices, and creating reports—so you can focus on what you love doing, like designing logos or baking cupcakes.

Launched in 2010 by a Canadian company, Wave has won over millions of users (over 5 million) with its easy-to-use interface and—get this—free core features.

Unlike those intimidating accounting programs that appear to have been designed by a robot with a grudge, Wave is built for regular people.

It’s like choosing a cozy diner over a fancy restaurant with a 10-page menu. Wave keeps things straightforward, so even if “balance sheet” sounds like something you’d find in a yoga studio, you can still use it with confidence.

What Wave Can Do?

Wave Accounting is like a toolbox filled with just the right gadgets for managing money. Here’s a peek at its main features, explained without the jargon:

1. Bookkeeping

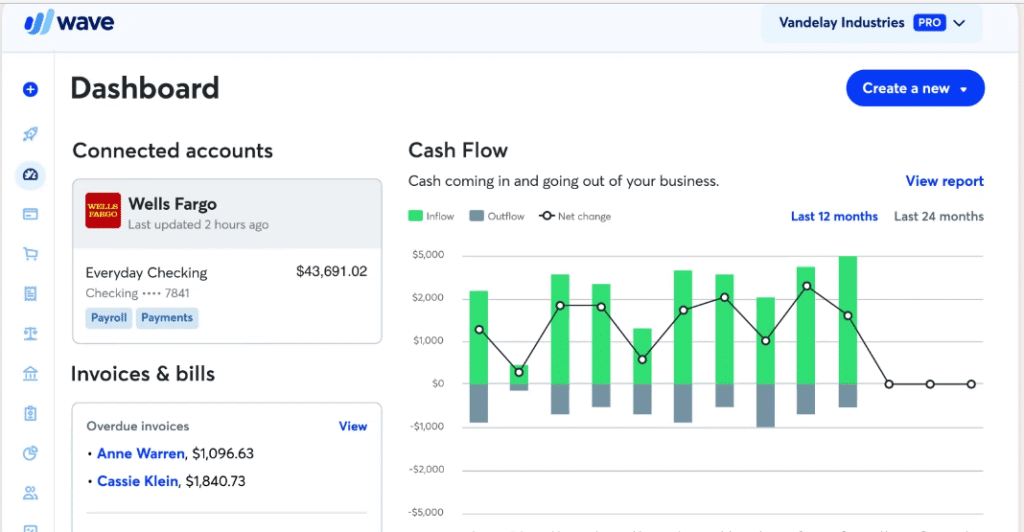

Wave’s bookkeeping feature is the star of the show. It lets you track income and expenses, sort transactions, and get a clear view of your financial health.

Connect your bank account or credit card, and Wave pulls in transactions automatically, sorting them into categories like “office supplies” or “client payments.”

No more typing out every single purchase—because who has time to log that $4 smoothie?

The dashboard is like a friendly report card for your business, showing cash flow, profits, and losses in a way that doesn’t require a calculator or a PhD.

It’s a quick way to see if your business is thriving or if you need to stop buying those fancy pens. (Noah, we’re looking at you and that $15 gel pen collection.)

2. Invoicing

Sending invoices can feel like shouting into the void, especially when clients take forever to pay. Wave makes it easy to create sharp-looking invoices in minutes.

You can add your logo, tweak the colors, and send them straight to clients’ inboxes. Wave even keeps tabs on who’s paid and who’s playing hide-and-seek with their wallet, so you can send friendly reminders without feeling like a debt collector.

Even better, Wave lets clients pay online with a credit card or bank transfer. The money hits your account faster than you can say “paid in full.”

For freelancers tired of chasing down payments, this is a game-changer. No more awkward “uh, about that invoice” emails.

3. Expense Tracking

Ever stared at your bank statement and wondered how you spent $200 on “miscellaneous”? Wave’s expense tracking is here to help.

Use the mobile app to snap photos of receipts— even that crumpled one from the gas station—and Wave organizes them for you. It’s like having a super-organized friend who loves filing paperwork.

This feature is a lifesaver during tax season, when you’re scrambling to find every possible deduction. (Pro tip: That business lunch counts, but the midnight pizza order probably doesn’t.)

4. Finance Reports

Wave’s reports are like a cheat sheet for your finances. Profit and loss statements, balance sheets, and sales tax reports come out clear and simple, so you don’t need to speak “accountant” to understand them.

These reports help you see where your money’s going and whether your business is on track—or if it’s time to rethink those impulse buys at the office supply store.

5. Payroll

If you’ve got employees or contractors, Wave’s payroll feature (available for a fee in some areas) handles paychecks, taxes, and direct deposits.

It’s like having a mini HR department without the office politics. While this feature isn’t free, it’s a small price to pay to keep everyone paid and the taxpayers happy.

Why Wave Stands Out

With so many accounting tools out there, why pick Wave? Let’s break it down with some real-world reasons.

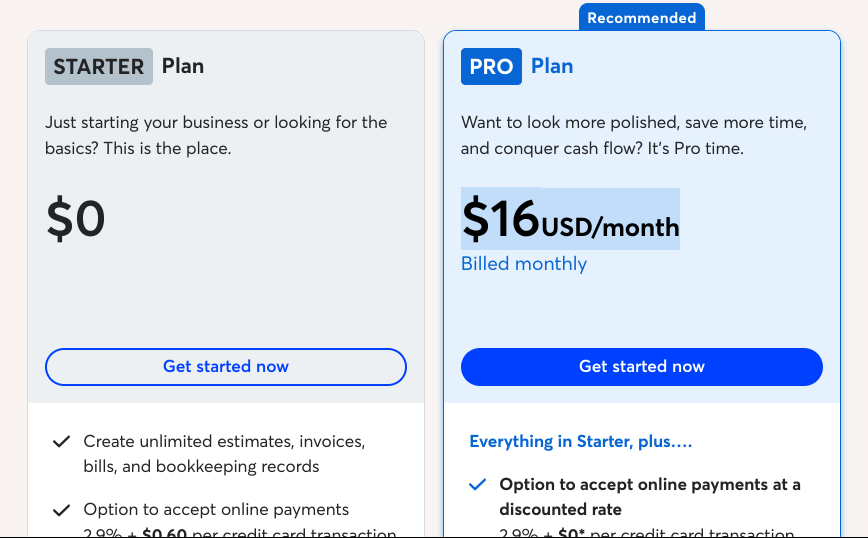

It’s Free (Freemium)

Wave’s core features—accounting, invoicing, and receipt scanning—are free. Completely, no-credit-card-required free.

In a world where even breathing seems to come with a subscription fee, this is a breath of fresh air. There are paid add-ons, like payroll and payment processing ($170/year billed annually & $16/month), but the free version is powerful enough for most small businesses.

It’s Cloud-Based

Wave is cloud-based, so you can access it from anywhere—your laptop, phone, or even that questionable Wi-Fi at the local café.

No software to install, no files to lose when your computer decides to crash. Your data is backed up and secure, so you can relax knowing your financial records won’t disappear like socks in a dryer.

It’s Easy to Use

Wave’s interface is clean and intuitive, like a well-organized desk. You don’t need to know terms like “general ledger” to get started.

The platform walks you through setup with helpful prompts, like a patient teacher who doesn’t mind explaining things twice. It’s perfect for busy entrepreneurs who’d rather focus on their work than wrestle with software.

It’s best for business

Whether you’re a solo freelancer or a small business with a growing team, Wave scales to fit your needs. It handles everything from basic expense tracking to multi-currency invoicing for international clients.

Think of it as a trusty backpack—roomy enough for now and ready to carry more when your business expands.

The Catch

Wave is awesome, but it’s not flawless. The free version comes with ads—nothing too annoying, but they’re there, like a fly buzzing around your picnic.

Paid features like payroll and payment processing can add up, especially if you’re processing lots of payments. Those transaction fees can sneak up on you like unexpected shipping costs on an online order.

Customer support is another area where Wave stumbles a bit. Free users get email support and a help center, but responses can take a day or two.

Paid users get priority, but it’s not instant live chat. If you’re someone who needs answers at midnight, you might feel a bit stranded.

Also, Wave isn’t built for huge, complex businesses. If you’re running a multinational corporation with a team of accountants, you’ll probably need something heavier, like QuickBooks or Xero.

But for small businesses, freelancers, or side hustlers, Wave is like that perfect pair of sneakers—comfy, reliable, and just right for the job.

Tips for Getting the Most Out of Wave

Ready to jump into Wave? Here are some simple tricks to make the most of it:

- Connect Everything: Connect your bank and credit cards to automate transaction imports. It’s like setting your thermostat to the perfect temperature—effortless.

- Customize Invoices: Add your logo and brand colors to make invoices pop. Clients will think you’re a big deal, even if you’re working from your couch.

- Use the Mobile App: Use the Wave accounting mobile app to capture receipts before they pile up. It’s faster than digging through your car’s glovebox at tax time.

- Check Reports Regularly: Glance at your profit and loss statement regularly. It’s like checking your phone battery—keeps you from running on empty.

- Set Reminders: Use Wave’s invoice reminders to gently prod clients who owe you. A little nudge can go a long way.

Wave vs. Rivals:

How does Wave compare to other accounting tools? Here’s a speedy showdown:

- Wave vs. QuickBooks: QuickBooks is powerful but expensive (starting at $25/month) and can feel like overkill for small businesses. Wave is simpler, cheaper, and perfect for startups.

- Wave vs. FreshBooks: FreshBooks shines for invoicing and time tracking, but starts at $15/month. Wave’s free plan wins for budget-conscious users.

- Wave vs. Spreadsheets: Spreadsheets are free, but a pain to manage. Wave automates the boring stuff, so you don’t accidentally mess up a formula and ruin your day.

Wrapping it Up

Wave Accounting is like that reliable friend who shows up with pizza when you’re stressed. It’s perfect for small business owners, freelancers, or anyone who wants to keep their finances organized without losing their mind.

The free plan is a steal, the interface is a breeze, and the time it saves is worth more than gold (or at least a really good latte).

So, if you’re like Noah, staring at a pile of receipts and dreading tax season, give Wave a shot. It won’t solve all your problems or walk your dogs, but it’ll make your financial life a whole lot easier.

And who knows? You might even have time to enjoy that coffee while it’s still hot.