Confused about what the 10990-NEC form is? Who needs it? How does it work? We’ve got your back.

This article breaks it all down in a clear, straightforward way. By the end, you’ll understand the 1099-NEC, why it matters, and how to handle it like a pro. Ready? Let’s barge forward.

What’s a 1099-NEC Form?

The 1099-NEC—short for Nonemployee Compensation—is a tax form issued by the IRS. It reports payments made to individuals or businesses who aren’t employees but provide services.

Think freelancers, contractors, or consultants. If you’ve hired someone to design a website, fix your plumbing, or write a report, and they’re not on your payroll, this form might come into play.

Before 2020, these payments were reported on the 1099-MISC form. But the IRS decided to give nonemployee compensation its own dedicated form to reduce confusion. Good move? Absolutely. It makes tracking income for independent workers much clearer.

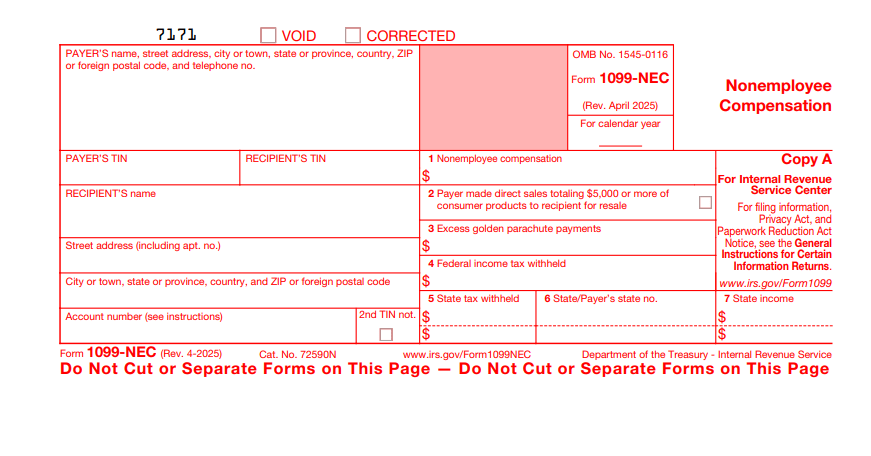

The form itself is straightforward. It lists:

- The payer’s name, address, and Taxpayer Identification Number (TIN).

- The recipient’s name, address, and TIN (or Social Security Number).

- The total amount paid for services during the tax year.

- Any federal or state income tax withheld (if applicable).

Sounds simple, right? But there’s more to it than meets the eye.

Who Gets a 1099-NEC?

So, who exactly receives this form? If you’re a freelancer, contractor, or self-employed individual, you’re likely to get one.

Here’s the deal: businesses must issue a 1099-NEC to anyone they’ve paid $600 or more in a tax year for services, provided that person or entity isn’t an employee. This includes:

- Freelancers. Graphic designers, writers, or coders working gig-to-gig.

- Independent contractors. Think plumbers, electricians, or consultants.

- Sole proprietors or LLCs. If you run a small business and provide services, you might get one.

- Gig workers. Drivers for rideshare apps or delivery services often receive 1099-NECs.

The catch? The $600 threshold applies per payer. So, if you work for multiple clients and each pays you less than $600, you might not get a 1099-NEC from them.

But here’s the kicker: you’re still responsible for reporting all income on your taxes, whether you get a form or not. Surprised? Don’t be. The IRS expects you to keep track.

What about businesses? If you’re a business owner who hires freelancers or contractors, you’re the one issuing the 1099-NEC.

You’ll need to collect a W-9 form from each worker to get their TIN and other details. No W-9? You might have to withhold 24% of their payment for backup withholding. Ouch. Nobody wants that.

Why 1099-NEC Is Important?

Why should you care about this form? Simple. It’s a critical piece of your tax puzzle. For recipients, the 1099-NEC tells the IRS how much you earned from a specific client.

When you file your taxes, you’ll use these forms to report your income accurately. Mess it up? You could face penalties, audits, or a bigger tax bill than expected. No thanks.

For businesses, issuing the 1099-NEC is just as important. It proves you’re reporting payments correctly to the IRS. Skip it, and you’re risking fines or legal headaches. The good news? Following the rules keeps everyone happy.

Here’s another reason it matters: taxes. Unlike employees, who have taxes withheld from their paychecks, 1099 workers are responsible for their own taxes. This includes:

- Income tax. Based on your total earnings.

- Self-employment tax. Covers Social Security and Medicare (about 15.3% of your net earnings).

Overwhelmed? Don’t be. Proper planning—like setting aside 25-30% of your income for taxes—can save you from a stressful tax season.

When and How Do You Get a 1099-NEC?

Timing is everything. Businesses must send 1099-NEC forms to recipients by January 31 of the following tax year. So, if you freelanced in 2024, expect forms by January 31, 2025. They’ll also send a copy to the IRS, so everyone’s on the same page.

How do you receive it? Typically, it arrives by mail or electronically (if you’ve agreed to e-delivery). Once you have it, check the details:

- Is your name and TIN correct?

- Does the payment amount match your records?

- Any tax withheld? If so, that’s credited toward your tax bill.

Mistakes happen. If something’s off, contact the payer ASAP to get a corrected form. Note: Keep your own records of all payments received. Why? Sometimes, payers forget to issue a 1099-NEC, but you still need to report that income.

How to File a 1099-NEC as a Recipient

Got your 1099-NEC? Awesome. Now what? Here’s a quick 3-step process to handle it like a pro:

- Gather all forms. Collect every 1099-NEC you receive, along with any other income records.

- Report the income. Use the amounts from Box 1 of each 1099-NEC to report your income on Schedule C (Profit or Loss from Business) when filing your taxes. This goes on your Form 1040.

- Calculate self-employment tax. Use Schedule SE to figure out your self-employment tax. The good news? You can deduct half of this tax on your 1040, softening the blow.

Need help? Tax software like TurboTax or FreeTaxUSA can guide you through this. Or, if your situation’s complex—say, you have multiple income streams—consider hiring a tax professional. Worth it? Often, yes.

A Few Things To Consider

Nobody’s perfect, but avoiding these pitfalls can save you headaches:

- Ignoring small payments. No 1099-NEC for payments under $600? You still need to report that income.

- Missing deadlines. Businesses must file by January 31. Recipients, align your tax prep with the April 15 deadline (or October 15 if you file an extension).

- Incorrect info. Double-check your TIN and payment amounts. Errors can delay your refund or trigger an audit.

- Forgetting deductions. As a 1099 worker, you can deduct business expenses—think office supplies, mileage, or internet costs. Don’t leave money on the table.

The takeaway? Stay organized. Keep receipts, track income, and use a spreadsheet or app to stay on top of things. Simple tools, big impact.

What You Can’t Get a 1099-NEC?

Sometimes, you won’t get a 1099-NEC. Maybe the payer paid you less than $600. Or they forgot. Or they’re just disorganized. What then? You’re still on the hook for reporting that income. Here’s how:

- Track all payments yourself. Use bank statements, invoices, or payment apps like PayPal or Venmo.

- Report the total on Schedule C, even without a 1099-NEC.

- If you suspect a payer didn’t report correctly, consult a tax professional to avoid IRS trouble.

Another scenario: what if you’re a business owner and forgot to issue a 1099-NEC? Act fast. File late forms with the IRS and explain the delay. Penalties are steep—up to $310 per form in 2025—so don’t procrastinate.

Tips for 1099-NEC Success

Want to make tax season a breeze? Try these:

- Set up a system. Use accounting software like QuickBooks or Wave to track income and expenses. Easy. Effective.

- Save for taxes. Open a separate savings account and stash 25-30% of every payment. Future you will thank you.

- Stay informed. Tax rules change. Check the IRS website or subscribe to tax newsletters for updates.

- Ask for help. Not sure about deductions or filing? A CPA or tax advisor can save you time and money.

The best part? These steps work for any 1099 worker, whether you’re a full-time freelancer or picking up side gigs.

Wrapping It Up

The 1099-NEC form isn’t just paperwork—it’s a key part of staying on the IRS’s good side. Whether you’re a freelancer receiving one or a business issuing it, understanding the process is crucial.

Who gets it? Anyone paid $600 or more for nonemployee services. Why does it matter? It ensures accurate income reporting and helps you plan for taxes. How do you handle it? With organization, attention to detail, and maybe a little help from tax software or a pro.

Feeling clearer? Great. The 1099-NEC might seem daunting at first, but it’s manageable with the right approach.

Stay on top of your records, know your responsibilities, and tax season will be less of a headache. Questions? Check the IRS website or consult a tax expert. You’ve got this.