- What’s IRS Form 8863?

- The Two Credits You Need to Know

- 1. American Opportunity Tax Credit (AOTC)

- 2. Lifetime Learning Credit (LLC)

- Who Can Claim These Credits?

- Where to find IRS Form 8863?

- IRS Website:

- Tax Software

- Local IRS Office

- How to Fill Out Form 8863?

- A Few Things To Consider

- Why Form 8863 Matters

- Wrapping it Up

Tax season can feel like navigating a maze blindfolded, but there’s a silver lining for students and their families: IRS Form 8863.

If you’re short on cash for your tuition fee or higher education, this form could help you save some serious cash.

But before you grab this opportunity, it’s important to know who can use Form 8863 and how it works. We’ve outlined all the major details on it so you can easily claim your credit.

What’s IRS Form 8863?

It’s a monetary aid that the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC) provide for taxpayers to reduce the burden of higher education fees.

The credits are not added, but the amount of tax owed is cut to ease the financial burden of a college or tuition fee.

In some cases, if your tax bill hits zero, part of the AOTC can even come back to you as a refund. Pretty sweet, right?

You can deem it as the letter you send to the IRS, mentioning – you’re in school and need some monetary help to pay your college bills. It’s a simple form that only requires some details to fill out to claim the credit.

The Two Credits You Need to Know

Let’s dive into the two stars of the show: the AOTC and the LLC. They’re different beasts, so understanding which one (or both) you qualify for is key.

1. American Opportunity Tax Credit (AOTC)

The AOTC is the rockstar of education credits, offering up to $2,500 per eligible student per year. Here’s the gist:

- Who’s eligible? The undergrad students, or enrolled at least half-time in a university, are eligible for the credit. You must be pursuing a college degree or in a vocational school to claim the Form 8863

- What expenses count? Students looking for monetary aid for tuition or courses, excluding transportation and personal expenses, can get the credit.

- How’s it calculated? You’ll receive the $2,500 of qualified expenses in two parts. Even better, up to $1,000 refundable if you owe no taxes.

- Income limits: Single filers should have their gross income between $80,000 and $90,000, and joint filers should have between $160,000 and $180,000.

2. Lifetime Learning Credit (LLC)

The LLC is a bit flexible compared to the AOTC, offering up to $2,000 per tax return. Here’s the criteria.

- Eligibility? Unlike AOTC, it helps students who want to improve their job skills by taking courses. They don’t need to pursue a degree to claim the credit.

- What expenses count? This is similar to the AOTC, but you can still count room and board. If you want aid for tuition fees or to join a course, this is for you.

- How’s it calculated? You get 20% of the first $10,000 of qualified expenses, up to $2,000 per return. Unlike the AOTC, the LLC is non-refundable, so it can only reduce your tax bill to zero, not beyond.

- Income limits (2025): There is not much disparity – single filers with MAGI should have an income limit between $80,000 to $90,000, and joint filers must meet the income limit between $160,000 and $180,000.

The LLC’s strength is its flexibility. Whether you’re a grad student, a part-time learner, or someone taking a coding bootcamp to switch careers, this credit has your back.

Who Can Claim These Credits?

Now comes the main question: who can claim these credits? If you’re wondering if you’re eligible for it or not, then here’s the answer.

- You’re a student paying your own qualified education expenses.

- You’re a parent or guardian claiming a dependent student (like your child).

- You’re married, filing jointly, and one of you incurred the expenses.

But there’s a catch: you can’t double-dip. For example, you can’t claim both the AOTC and LLC for the same student in the same year.

Unfortunately, if you’re student wants to claim the credit on someone else’s return, you can’t qualify. On top of that, you’re an NRI, or nonresident pursuing a college degree on scholarships, you can qualify for either.

Where to find IRS Form 8863?

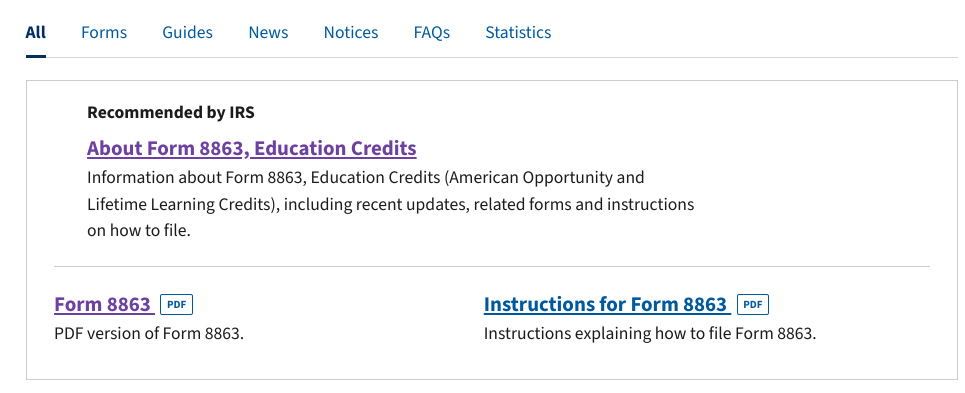

IRS Website:

Head over to the www.irs.gov, search “Form 8863” in the search bar. You’ll see a PDF download option for “Form 8863” on the left. If you want in-depth instructions, download the right PDF

Tax Software

Software like TurboTax or H&R Block will help immensely if you’re new to the filing. Software integrates the form into its filing process for an error-free and smooth experience.

Local IRS Office

We won’t recommend this old-school method, but if you’re afraid of software and online filing, you can request a physical copy at an IRS office or contact representatives for instructions.

How to Fill Out Form 8863?

Filling out Form 8863 is not all that complicated if you’ve all the information handy with you. Here’s a quick roadmap:

- Get your documents. You’ll need:

- Form 1098-T – You can get this form from your educational institution. It shows your tuition fee scholarships you received.

- You’ll need the form W-2 or 1040 to show your income details.

- Receipts for course materials, if asked.

- Part I: AOTC. If you’re claiming the AOTC, fill out this section with the student’s name, SSN, and qualified expenses. The form will guide you through calculating the credit.

- Part II: LLC. Same here—enter the student’s info and expenses, then figure out the credit.

- Part III: Student and Institution Info. This is where you list the students’ and school’s details, like the institution’s Employer Identification Number (EIN) from Form 1098-T.

- Double-check your math. The form can calculate on its own, but mistakes may happen. So, make sure your expenses and income are in line with the IRS.

- Attach to your return. Once everything is filled up, attach your Form 8863 with the Form 1040 when you file your taxes.

Note: If you’re overwhelmed, we recommend using tax software as it can streamline filing with no errors, ensuring you’re claiming the right credit.

A Few Things To Consider

Nobody wants to mess up their taxes, so here are some traps to sidestep:

- Mixing up credits. Don’t claim both AOTC and LLC for the same student in the same year. Pick the one that gives you the bigger benefit.

- Incorrect expenses. Only claim qualified expenses. That gym membership or dorm room decor? Nope, not eligible.

- Missing income limits. Check your Modified Adjusted Gross Income or MAGI for your eligibility. If your income exceeds or falls below the limit, a small income tweak like contributing to an IRA can qualify you.

- Forgetting Form 1098-T. Schools send this by January 31, so don’t file without it. If it’s missing, contact the school ASAP.

Why Form 8863 Matters

Form 8863 is an aid for students who’re grinding through late-night study sessions, or want to join a college. The amount that comes with that form can help parents tackle the fee issue at college or tuition acceptance. And there is no doubt that student fees are rising daily, causing parents to work overtime.

Suppose you’re a single father with a $20,000 annual salary, who has paid $5,000 in tuition fees. The slashed amount is so huge that it will impact your life. But with the AOTC, you could claim $2,500 off your taxes, or even if it’s $1,000, you can splurge it on books, rent, or something else.

Wrapping it Up

If you’re a student, IRS Form 8863 is no less than any Messiah. However, it comes with strings attached, but still a huge aid to pay education fees or buy courses.

If you get the hang of AOTC and LLC, and are eligible, you can easily file for the credit and unlock savings that make college feel a little less daunting.

So, without any further delay, give Form 8863 a spin. But ensure you double-check your expenses before it.