Ever thought about how investors know how much they’re making out of their investments? That’s when Yield comes into play.

It’s one of the most popular terms in finance that shows the percentage of your investment returns.

It’s widely used in the investment and loan field, where money is invested for a few hours to even long-term.

However, it’s not the final cash you receive, as you can calculate yield as an estimate too, while putting your funds into a business or stock.

So, with any further delay, let’s unravel the enigma of yield, breaking down its definition and formulas in a way that’s crystal clear.

What Yield Really Means

Yield means the return you get on an investment, usually defined as a percentage. You can deem it as the earnings generated from putting your money into something like a bond or a stock, depending on the amount you invested.

Not only does it help compare different options, but it also gives a sense of how profitable an investment might be over time.

In mathematical terms, calculating yield involves looking at the income produced, such as interest or dividends, and dividing that by the investment’s cost or value.

Because investments vary, yield can take different forms depending on what you’re dealing with. For instance, in bonds, it’s about the interest payments, while in stocks, it often ties to dividends.

You can use yield to gauge if an investment aligns with your goals, whether saving for a house or building retirement funds.

Understanding yield starts with recognizing its role in everyday finance. When buying a bond, the yield tells you what percentage return to expect annually.

This isn’t just a number; it reflects market conditions, interest rates, and even economic health.

As inflation rises, yields might adjust because investors demand higher returns to offset rising costs. Keeping an eye on these changes helps you make smarter choices.

The Basic Definition of Yield

At its core, yield is the income return on an investment. Expressed annually, it shows how much you earn from interest, dividends, or other payouts relative to the principal amount. Principal here means the original sum you invest.

You must consider that yield differs from total return, which includes capital gains or losses. Yield focuses solely on the income part.

For example, if a stock pays dividends, the yield is calculated based on those payments divided by the stock’s price. This distinction matters because while prices fluctuate, yields provide a steady metric for comparison.

Defining yield more precisely, it’s often categorized by asset type. In fixed-income securities like bonds, yield measures the interest earned. For equities, it’s the dividend yield. Real estate might involve rental yield.

Each type uses similar principles but applies them differently, ensuring you can evaluate across portfolios.

Key Formulas for Calculating Yield

Formulas make yield tangible. Starting with the simplest: current yield equals annual income divided by the current market price, multiplied by 100 for the percentage. You can apply this to bonds or stocks alike.

For bonds, the formula looks like this:

Suppose a bond pays $50 in interest yearly and trades at $1,000; the yield is 5%.

Adjusting for market changes, if the price drops to $900, the yield rises to about 5.56%, showing how price inversely affects yield.

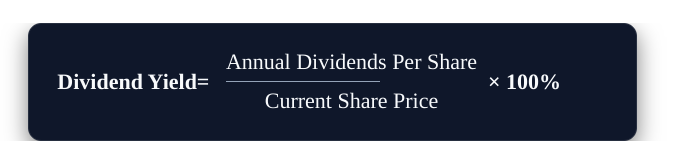

Dividend yield for stocks follows a similar path:

If a company pays $2 per share in dividends and the stock costs $40, the yield hits 5%. Tracking this over time reveals company health, as consistent dividends suggest stability.

Yield to maturity (YTM) adds complexity for bonds, factoring in time until maturity, coupon payments, and the difference between purchase price and face value.

YTM = [C + (F − P) / n] ÷ [(F + P) / 2]

The C represents Annual Coupon Payment, F represents the Face Value of the Bond, P shows the Current Market Price, and n is Years to Maturity.

The formula involves solving for the interest rate in a present value equation, often requiring a calculator or spreadsheet. This gives a rough estimate, helping you decide if holding a bond long-term makes sense.

In real estate, rental yield is calculated as

Gross Rental Yield = (Annual Rental Income / Property Value) × 100.

Net yield subtracts expenses like maintenance. These formulas empower you to assess if a property generates enough income to cover costs and provide profit.

Types of Yield

Diving deeper, various yields suit different investments. Bond yields include nominal, current, and yield to maturity. Nominal yield is the stated interest rate on the bond, unchanged by market fluctuations. Current yield adjusts for price changes, offering a real-time view.

Yield to maturity stands out because it assumes reinvestment of coupons at the same rate, providing a comprehensive return if held until the end.

You must watch this when interest rates shift, as rising rates can lower bond prices, increasing YTM for new buyers.

Stock yields focus on dividends. Trailing yield uses past dividends, while forward yield projects future ones based on estimates.

High dividend yields attract income-focused investors, but beware: excessively high yields might signal company troubles, like unsustainable payouts.

Earnings yield flips the price-to-earnings ratio: Earnings Yield = (Earnings Per Share / Share Price) × 100. This compares stocks to bonds, where a higher earnings yield suggests undervaluation. Using this, you can spot opportunities in volatile markets.

In mutual funds or ETFs, distribution yield reflects payouts from interest or dividends. SEC yield standardizes this for 30 days, aiding fair comparisons. These types ensure you tailor evaluations to specific needs.

Why Yield Matters

Yield influences decisions profoundly. High yields tempt, but risks lurk. For bonds, higher yields often mean lower credit quality, increasing default chances. Balancing yield with safety is key.

In portfolios, yield contributes to income generation. Retirees rely on it for a steady cash flow without selling assets. Diversifying across yield types mitigates risks, as bond yields provide stability while stock yields offer growth potential.

Market conditions affect yields. During economic downturns, central banks lower rates, compressing yields. Conversely, growth periods see rising yields. Monitoring these trends helps time investments effectively.

Yield curves plot yields against maturities, signaling economic outlooks. Inverted curves, where short-term yields exceed long-term, often precede recessions. Understanding this prepares you for shifts.

How to Use Yield

Applying yield practically enhances financial literacy. When choosing bonds, compare YTM across options. If one offers 4% YTM over five years and another 3% over ten, factor in time horizons and liquidity needs.

For stocks, scan dividend yields in sectors like utilities or consumer goods, known for reliability. Avoid chasing high yields without checking payout ratios, which show dividend sustainability.

In real estate, calculate yield before buying. If a property rents for $20,000 yearly and costs $300,000, the gross yield is about 6.67%. Subtracting expenses refines this, revealing true profitability.

Portfolios benefit from yield laddering, spreading maturities to manage interest rate risks. This strategy ensures consistent income, adapting to changes.

Advanced Concepts in Yield

Exploring further, effective yield accounts for compounding frequency. For semi-annual coupons, it’s higher than nominal. Formula: Effective Yield = (1 + (Nominal / m))^m – 1, where m is the compounding periods.

Option-adjusted yield factors in embedded options, like callable bonds. This adjusts for issuer redemption risks, providing realistic expectations.

In international investing, currency yields add layers. Hedging against exchange rates preserves yields.

Sustainable yield in endowments ensures principal preservation while generating income. Formulas balance withdrawals with growth.

Tools and Resources for Calculating Yield

- You can use Excel spreadsheets for formulas. All you need to do is Just Input data, and the functions compute YTM via iteration.

- Financial websites provide calculators that you can use by simply inputting variables, and you’ll get instant results.

- Apps are another way to track portfolio yields, with features like alerts, save, and more.

- Brokers may offer analytics and compare yields across assets.

Wrapping Up

Mastering yield equips you for informed decisions. From definitions to formulas, applying these concepts builds confidence.

Whether bonds, stocks, or real estate, yield guides toward financial goals. It’s worth noting that consistent evaluation ensures alignment with strategies.

This article covers the basics and beyond, empowering you to navigate finance effectively. By integrating yield into routines, you can calculate your outcome.